Fitness

Get reimbursed for Centr with your HSA/FSA funds

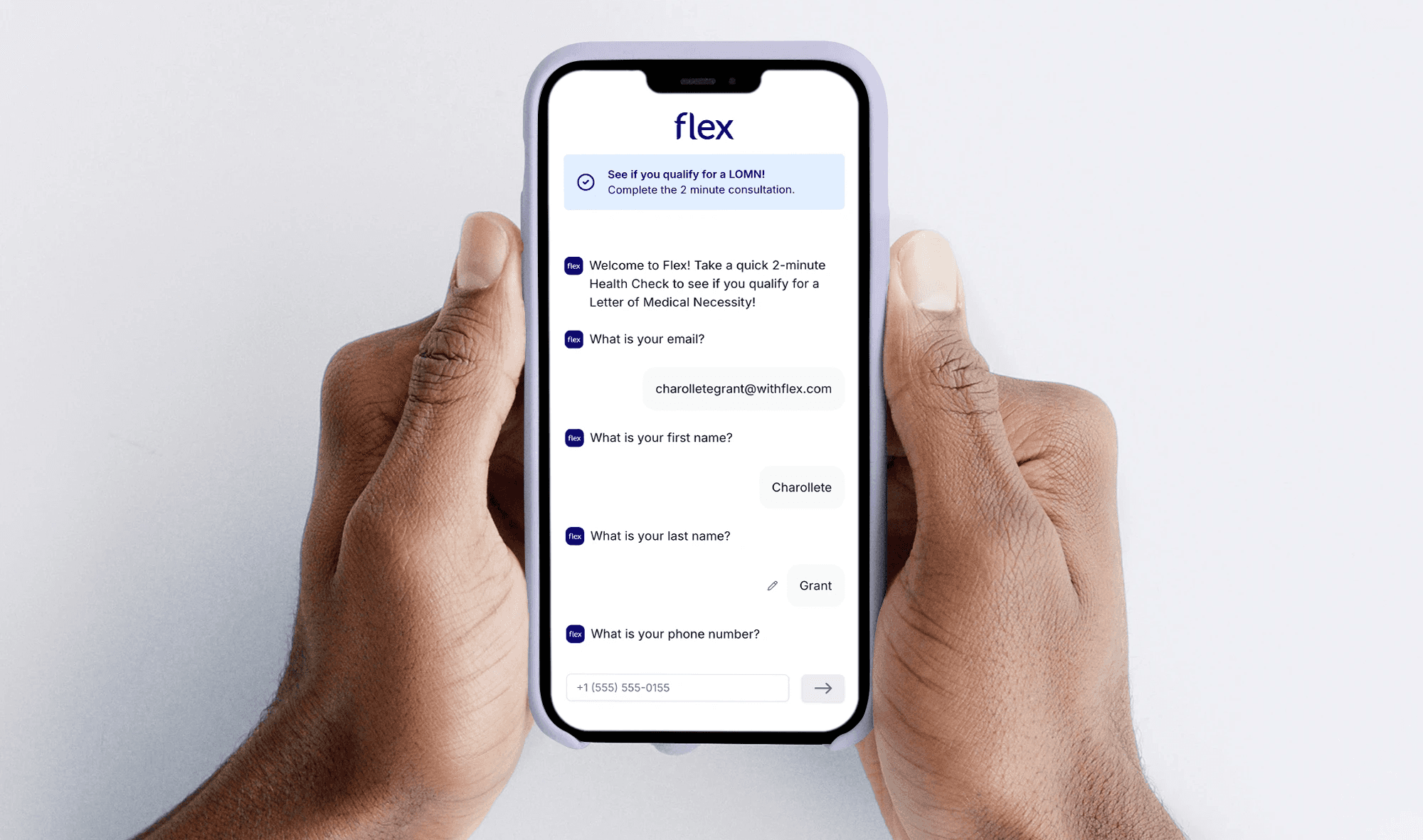

Check if you qualify for a Letter of Medical Necessity and submit for HSA/FSA reimbursement.

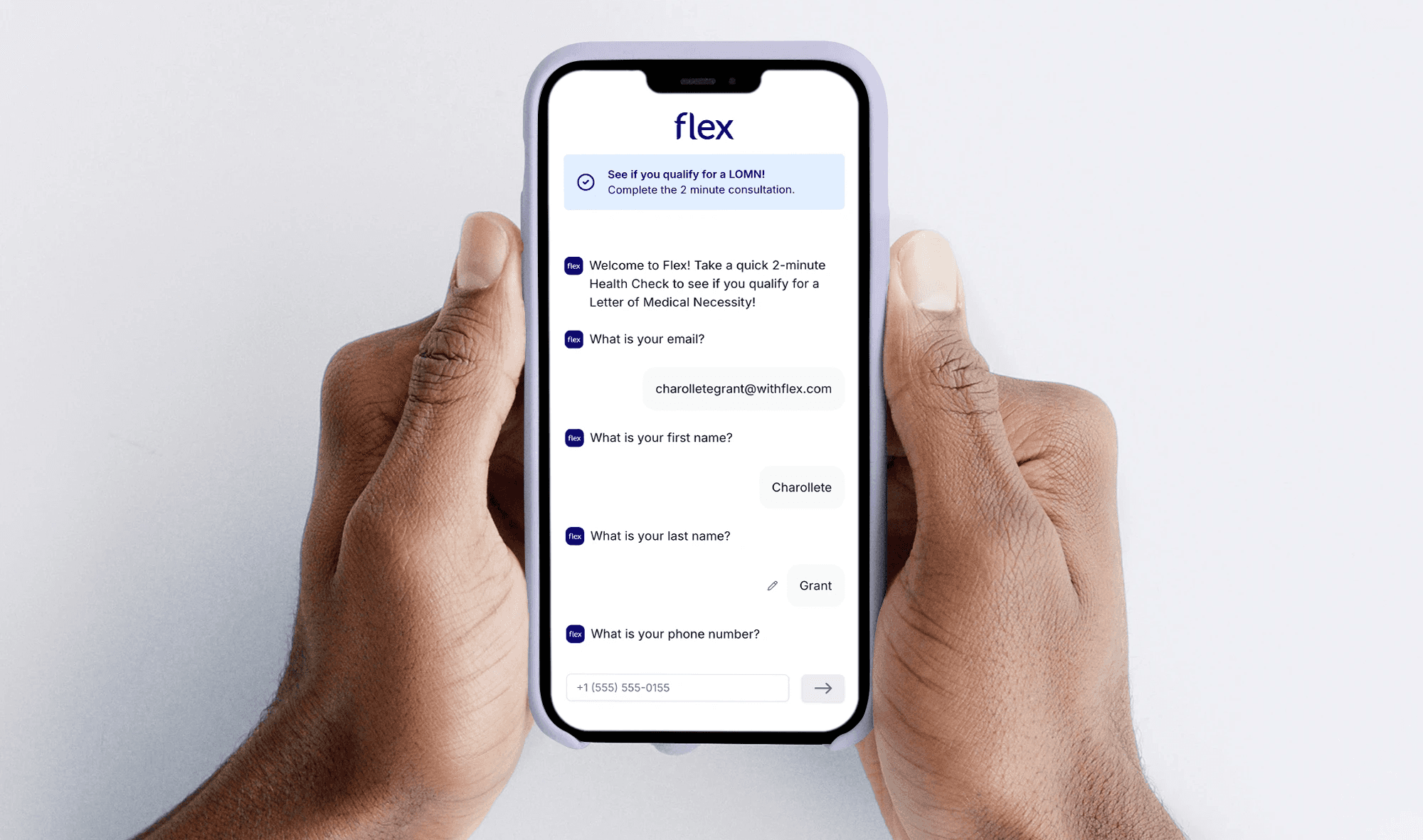

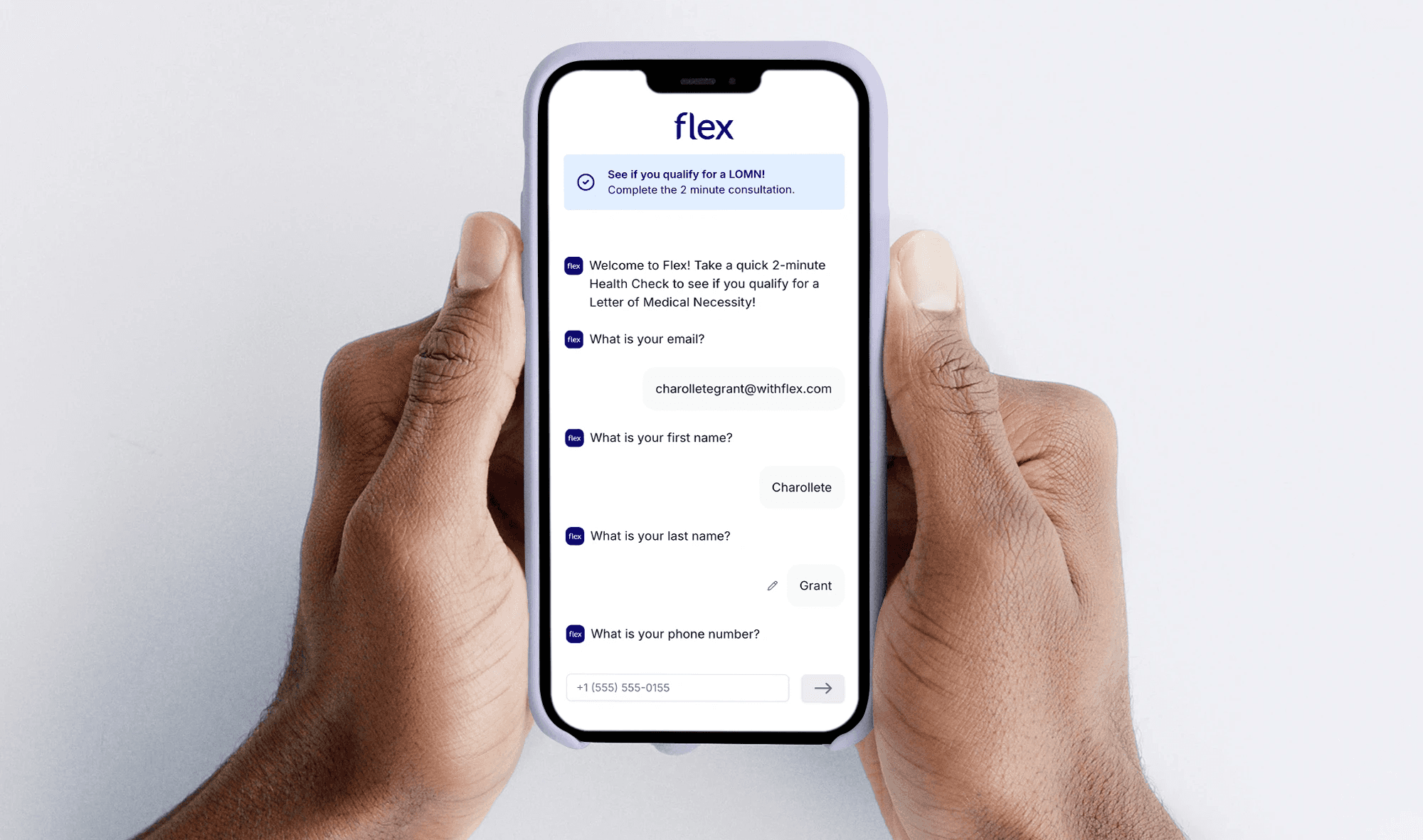

Instant chat consultation—no scheduling or video required

Qualifying consumers receive their Letter in < two hours

$20 consultation fee (HSA/FSA eligible)

Fitness

Centr

Centr

Centr

Centr

SAVE USING PRE-TAX DOLLARS

SAVE USING PRE-TAX DOLLARS

SAVE USING PRE-TAX DOLLARS

How to get reimbursed from your HSA/FSA

How to get reimbursed from your HSA/FSA

How to get reimbursed from your HSA/FSA

1

Complete your consultation

Complete a quick, 2-minute consultation. A licensed provider will to determine your eligibility. If eligible, you’ll receive a Letter of Medical Necessity in under two hours.

2

Make your purchase from Centr

Visit Centr to pay for your membership with a standard payment method. Do not use your HSA/FSA card at checkout.

3

Submit for HSA/FSA reimbursement

Follow Flex's instructions to submit your Letter and Centr receipt to your HSA/FSA administrator for reimbursement.

QUALIFY TODAY

QUALIFY TODAY

QUALIFY TODAY

Why use Flex?

Why use Flex?

Why use Flex?

Your Letter of Medical Necessity will be valid for one year on future expenses.

Your Letter of Medical Necessity will be valid for one year on future expenses.

Your Letter of Medical Necessity will be valid for one year on future expenses.

LOW PRICE

$20

You pay a one-time $20 fee for the Letter of Medical Necessity.

ON DEMAND

2min

No scheduling required. Convenient chat-based consultation available immediately.

SAVINGS

30%

You save 30-40% through reimbursement of HSA/FSA funds.

Unlock HSA/FSA REIMBURSEMENT

See if you qualify for a Letter of Medical Necesity

Our streamlined consultation process will determine if you’re eligible for a Letter of Medical Necessity, allowing you to make the most out of your pre-tax dollars.

READ MORE

READ MORE

READ MORE

Resources

Resources

Resources

Still have questions? Head over to the Flex blog to read more about HSAs and FSAs.

Still have questions? Head over to the Flex blog to read more about HSAs and FSAs.

Still have questions? Head over to the Flex blog to read more about HSAs and FSAs.

LEARN MORE

LEARN MORE

LEARN MORE

Frequently asked questions

Frequently asked questions

Frequently asked questions

If you can’t find what you’re looking for, please reach out to support@withflex.com

If you can’t find what you’re looking for, please reach out to support@withflex.com

If you can’t find what you’re looking for, please reach out to support@withflex.com

What’s an HSA or FSA?

Health Savings Accounts (HSAs) let you set aside pre-tax dollars to pay for qualified health expenses. HSAs are linked to high-deductible health plans, and funds in these accounts roll over year after year.

Flexible Spending Accounts (FSAs) allow you to use pre-tax dollars for eligible health expenses. Unlike HSAs, FSAs are not tied to a specific health plan and often require you to use the funds within the calendar year. FSAs are typically provided by employers.

What’s an HSA or FSA?

Health Savings Accounts (HSAs) let you set aside pre-tax dollars to pay for qualified health expenses. HSAs are linked to high-deductible health plans, and funds in these accounts roll over year after year.

Flexible Spending Accounts (FSAs) allow you to use pre-tax dollars for eligible health expenses. Unlike HSAs, FSAs are not tied to a specific health plan and often require you to use the funds within the calendar year. FSAs are typically provided by employers.

What’s an HSA or FSA?

Health Savings Accounts (HSAs) let you set aside pre-tax dollars to pay for qualified health expenses. HSAs are linked to high-deductible health plans, and funds in these accounts roll over year after year.

Flexible Spending Accounts (FSAs) allow you to use pre-tax dollars for eligible health expenses. Unlike HSAs, FSAs are not tied to a specific health plan and often require you to use the funds within the calendar year. FSAs are typically provided by employers.

What’s a Letter of Medical Necessity?

A Letter of Medical Necessity is a document from a licensed healthcare provider that verifies the medical necessity of a product or service, making it eligible for HSA or FSA reimbursement. This might include items or treatments like supplements or physical therapy that aren’t automatically recognized as eligible expenses.

What’s a Letter of Medical Necessity?

A Letter of Medical Necessity is a document from a licensed healthcare provider that verifies the medical necessity of a product or service, making it eligible for HSA or FSA reimbursement. This might include items or treatments like supplements or physical therapy that aren’t automatically recognized as eligible expenses.

What’s a Letter of Medical Necessity?

A Letter of Medical Necessity is a document from a licensed healthcare provider that verifies the medical necessity of a product or service, making it eligible for HSA or FSA reimbursement. This might include items or treatments like supplements or physical therapy that aren’t automatically recognized as eligible expenses.

Am I eligible for a Letter of Medical Necessity?

A licensed clinician will determine your eligibility during a chat-based telehealth consultation. According to IRS guidelines, you must have a medical condition that warrants the product or service you intend to purchase using your HSA/FSA. A range of conditions—such as cardiovascular, metabolic, musculoskeletal, autoimmune, neurological, or mental health conditions—could qualify.

Am I eligible for a Letter of Medical Necessity?

A licensed clinician will determine your eligibility during a chat-based telehealth consultation. According to IRS guidelines, you must have a medical condition that warrants the product or service you intend to purchase using your HSA/FSA. A range of conditions—such as cardiovascular, metabolic, musculoskeletal, autoimmune, neurological, or mental health conditions—could qualify.

Am I eligible for a Letter of Medical Necessity?

A licensed clinician will determine your eligibility during a chat-based telehealth consultation. According to IRS guidelines, you must have a medical condition that warrants the product or service you intend to purchase using your HSA/FSA. A range of conditions—such as cardiovascular, metabolic, musculoskeletal, autoimmune, neurological, or mental health conditions—could qualify.

How long is my Letter of Medical Necessity valid for?

Your Letter of Medical Necessity is valid for 12 months from the date of issue. It can be used for any eligible purchases made during this time. Be sure to keep and submit all related receipts when filing for reimbursement with your HSA/FSA administrator.

How long is my Letter of Medical Necessity valid for?

Your Letter of Medical Necessity is valid for 12 months from the date of issue. It can be used for any eligible purchases made during this time. Be sure to keep and submit all related receipts when filing for reimbursement with your HSA/FSA administrator.

How long is my Letter of Medical Necessity valid for?

Your Letter of Medical Necessity is valid for 12 months from the date of issue. It can be used for any eligible purchases made during this time. Be sure to keep and submit all related receipts when filing for reimbursement with your HSA/FSA administrator.

How do I use my HSA/FSA with Centr?

Go to Flex’s Shop and select the product or service you want to purchase.

Complete the chat-based telehealth consultation to confirm eligibility.

If eligible, you’ll receive your Letter of Medical Necessity via email.

Submit the Letter and proof of purchase to your HSA/FSA administrator for reimbursement.

How do I use my HSA/FSA with Centr?

Go to Flex’s Shop and select the product or service you want to purchase.

Complete the chat-based telehealth consultation to confirm eligibility.

If eligible, you’ll receive your Letter of Medical Necessity via email.

Submit the Letter and proof of purchase to your HSA/FSA administrator for reimbursement.

How do I use my HSA/FSA with Centr?

Go to Flex’s Shop and select the product or service you want to purchase.

Complete the chat-based telehealth consultation to confirm eligibility.

If eligible, you’ll receive your Letter of Medical Necessity via email.

Submit the Letter and proof of purchase to your HSA/FSA administrator for reimbursement.

When will I receive my Letter of Medical Necessity?

You’ll receive your Letter of Medical Necessity on the same day as your consultation, often within a few hours.

When will I receive my Letter of Medical Necessity?

You’ll receive your Letter of Medical Necessity on the same day as your consultation, often within a few hours.

When will I receive my Letter of Medical Necessity?

You’ll receive your Letter of Medical Necessity on the same day as your consultation, often within a few hours.

When will I receive my itemized receipt?

If you completed your purchase with Flex, your itemized receipt will be sent immediately after checkout.

When will I receive my itemized receipt?

If you completed your purchase with Flex, your itemized receipt will be sent immediately after checkout.

When will I receive my itemized receipt?

If you completed your purchase with Flex, your itemized receipt will be sent immediately after checkout.

How much will I save using my HSA/FSA funds?

Using HSA/FSA funds reduces the amount of income tax you pay, effectively lowering the cost of health-related purchases by using pre-tax dollars. Most consumers save between 30–40%, depending on their tax bracket.

How much will I save using my HSA/FSA funds?

Using HSA/FSA funds reduces the amount of income tax you pay, effectively lowering the cost of health-related purchases by using pre-tax dollars. Most consumers save between 30–40%, depending on their tax bracket.

How much will I save using my HSA/FSA funds?

Using HSA/FSA funds reduces the amount of income tax you pay, effectively lowering the cost of health-related purchases by using pre-tax dollars. Most consumers save between 30–40%, depending on their tax bracket.

How do I submit a Letter of Medical Necessity for reimbursement?

Locate your HSA/FSA administrator (typically through your employer’s HR department or health insurance provider).

Log in to your account on the administrator’s online platform.

Navigate to the “Reimbursement” or “Claims” section.

Upload your Letter of Medical Necessity and receipts for related purchases made after the letter’s issue date.

Submit your claim. Processing can take several days to a few weeks.

How do I submit a Letter of Medical Necessity for reimbursement?

Locate your HSA/FSA administrator (typically through your employer’s HR department or health insurance provider).

Log in to your account on the administrator’s online platform.

Navigate to the “Reimbursement” or “Claims” section.

Upload your Letter of Medical Necessity and receipts for related purchases made after the letter’s issue date.

Submit your claim. Processing can take several days to a few weeks.

How do I submit a Letter of Medical Necessity for reimbursement?

Locate your HSA/FSA administrator (typically through your employer’s HR department or health insurance provider).

Log in to your account on the administrator’s online platform.

Navigate to the “Reimbursement” or “Claims” section.

Upload your Letter of Medical Necessity and receipts for related purchases made after the letter’s issue date.

Submit your claim. Processing can take several days to a few weeks.

When should I expect to be reimbursed?

Reimbursement times vary but can take several weeks. For a specific timeline, contact your HSA or FSA administrator directly.

When should I expect to be reimbursed?

Reimbursement times vary but can take several weeks. For a specific timeline, contact your HSA or FSA administrator directly.

When should I expect to be reimbursed?

Reimbursement times vary but can take several weeks. For a specific timeline, contact your HSA or FSA administrator directly.