Case Study

A Health Win: Trainwell Increases Trial Conversions by 20% by Accepting HSA/FSA Payments

Trainwell stands alone by offering affordable personalized workout plans 🏋🏻, one-on-one online training, and the option to pay with HSA and FSA.

September 9, 2024

Sam O'Keefe

Co-founder & CEO of Flex

Overview

Overview

Overview

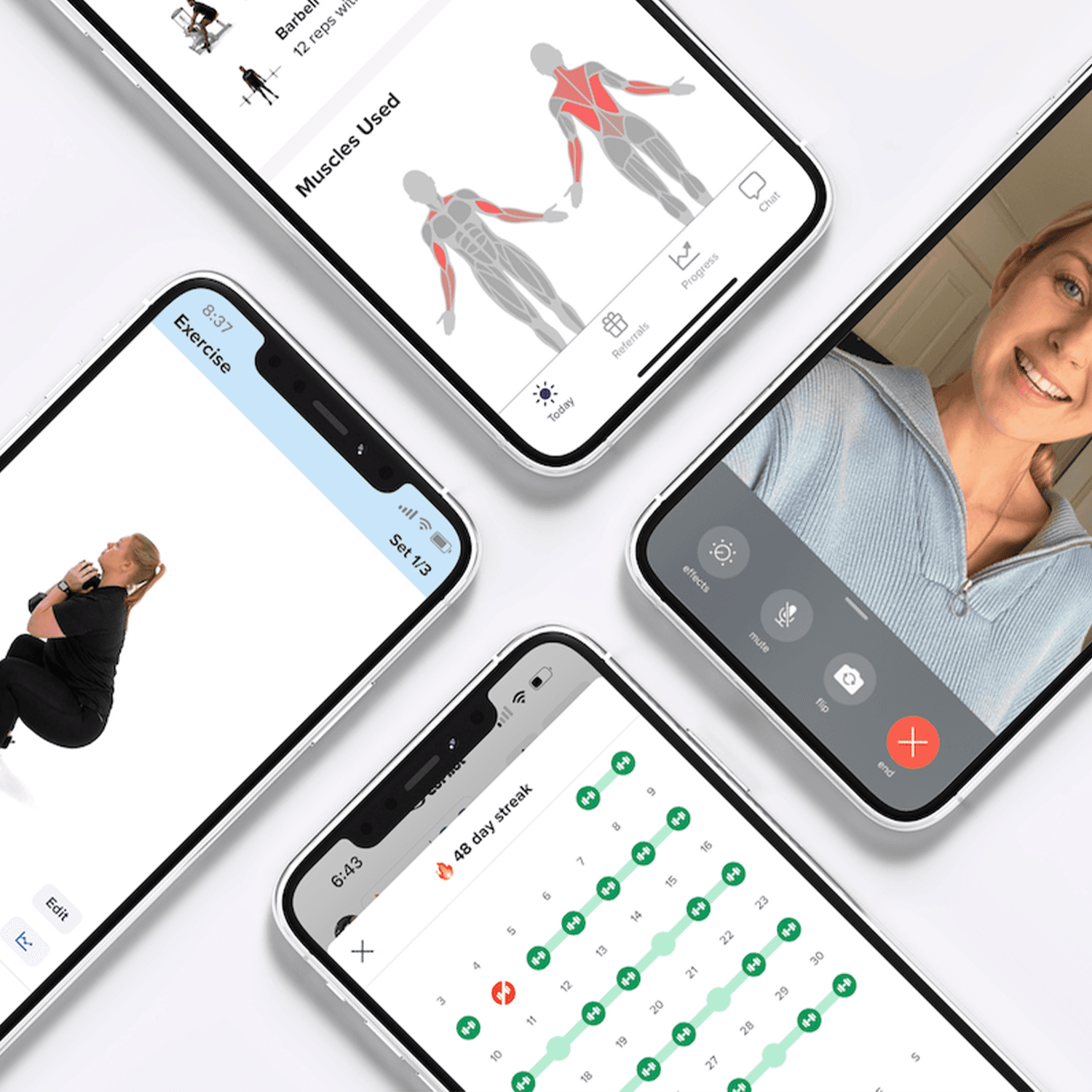

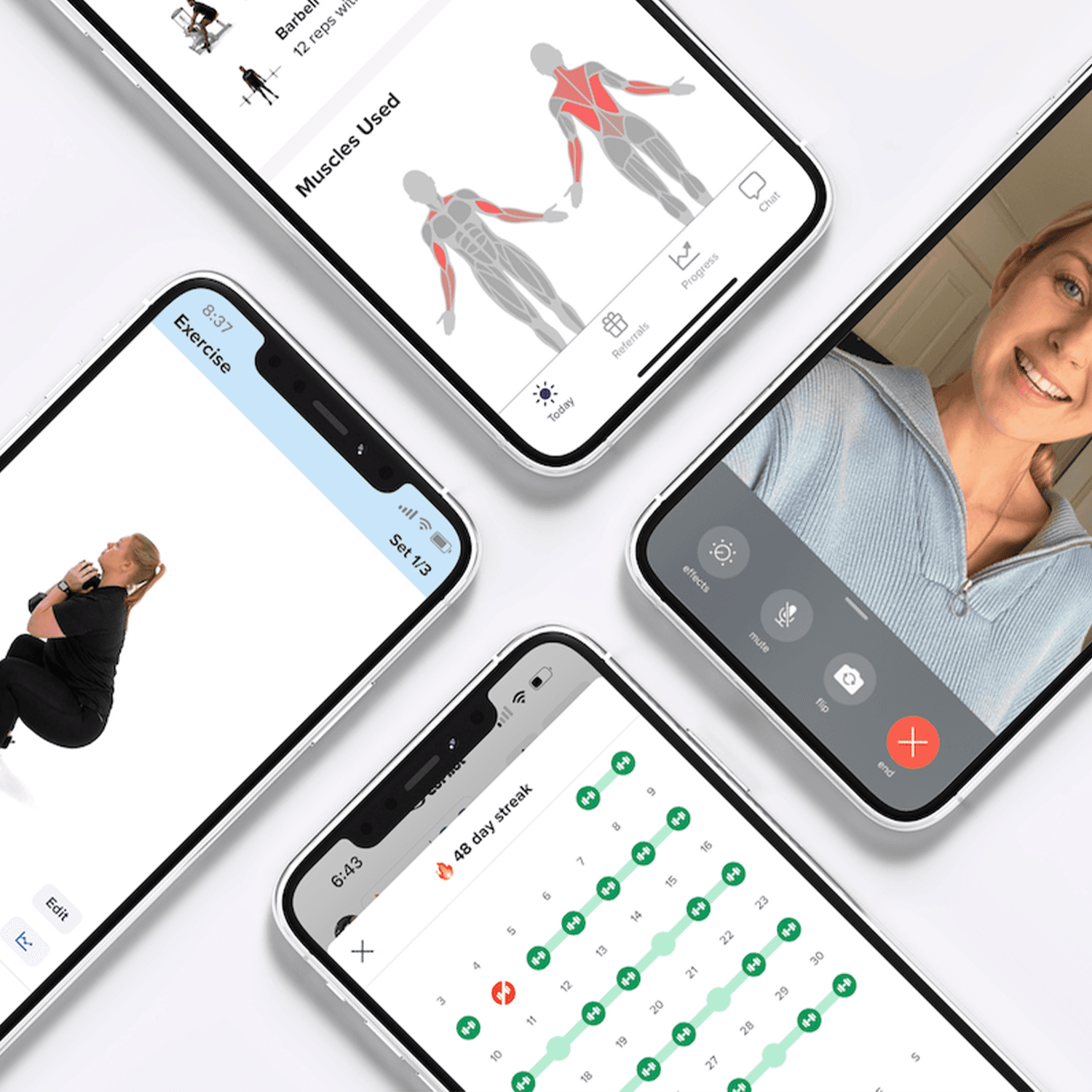

In the increasingly digital-only fitness space, Trainwell keeps the personal in personalized workout plans thanks to a human touch.

It starts by pairing clients with one of the company’s certified personal trainers. After an initial assessment and virtual call, the coach then tailors a fitness plan to meet the client’s unique goals and training style. Net-net, clients get all of the accountability and expertise of a personal trainer with the flexibility of a fitness app, so they can work out anytime and anywhere while still getting real-time feedback.

To further support customers along their fitness journey, Trainwell wanted to empower clients with more ways to pay.

Payment Options Matter for Customers on Their Fitness Journey

Since COVID made work-and-workout from home a thing, consumers have been looking for more ways to take control of their health and fitness, including how to pay.

Trainwell started by going right to the source — insurance companies — but found a lot of red tape. Then their customers surfaced an alternative:

“We started seeing a lot of people reaching out asking if they can pay for the service using their Health Saving Account (HSA) or Flexible Spending Account (FSA),” shares John LaGue, the COO of Trainwell. “Some clients were already figuring out the process on their own but we wanted to simplify things to allow all clients to experience the cost-savings.”

On average, consumers save 30 to 40% percent on purchases they make with their HSA or FSA because they are tax-advantaged tools.

The Ability to Pay With HSA or FSA Pays off for Trial Users

Trainwell began working with Flex to accept HSA and FSA payments.

To test the reception, the company sent messaging to a subset of their trial users about these speciality savings accounts and how they can be used to pay for services like Trainwell. At the end of the trial, the outcome was significant:

Trainwell saw a 20% lift in conversion from free trial to 3-month subscription among the test group.

“Our customers let us know they were very excited that they could now cover this with their HSA or FSA,” says LaGue.

Clients Can Stay Focused on Their Fitness Without Sweating the Price

HSAs an FSAs make paying for personal health simpler, which is great news for fitness brands.

Because the funds are already earmarked for health-related expenses, consumers don’t have to negotiate about how to spend the money — if they find a service they like, such as Trainwell, they can simply use the funds they already have without worrying how they’re going to pay for it.

Stats

1,000 free trial clients opted in to receive HSA/FSA education emails

20% increase in trial conversions for HSA/FSA opt-in group

In the increasingly digital-only fitness space, Trainwell keeps the personal in personalized workout plans thanks to a human touch.

It starts by pairing clients with one of the company’s certified personal trainers. After an initial assessment and virtual call, the coach then tailors a fitness plan to meet the client’s unique goals and training style. Net-net, clients get all of the accountability and expertise of a personal trainer with the flexibility of a fitness app, so they can work out anytime and anywhere while still getting real-time feedback.

To further support customers along their fitness journey, Trainwell wanted to empower clients with more ways to pay.

Payment Options Matter for Customers on Their Fitness Journey

Since COVID made work-and-workout from home a thing, consumers have been looking for more ways to take control of their health and fitness, including how to pay.

Trainwell started by going right to the source — insurance companies — but found a lot of red tape. Then their customers surfaced an alternative:

“We started seeing a lot of people reaching out asking if they can pay for the service using their Health Saving Account (HSA) or Flexible Spending Account (FSA),” shares John LaGue, the COO of Trainwell. “Some clients were already figuring out the process on their own but we wanted to simplify things to allow all clients to experience the cost-savings.”

On average, consumers save 30 to 40% percent on purchases they make with their HSA or FSA because they are tax-advantaged tools.

The Ability to Pay With HSA or FSA Pays off for Trial Users

Trainwell began working with Flex to accept HSA and FSA payments.

To test the reception, the company sent messaging to a subset of their trial users about these speciality savings accounts and how they can be used to pay for services like Trainwell. At the end of the trial, the outcome was significant:

Trainwell saw a 20% lift in conversion from free trial to 3-month subscription among the test group.

“Our customers let us know they were very excited that they could now cover this with their HSA or FSA,” says LaGue.

Clients Can Stay Focused on Their Fitness Without Sweating the Price

HSAs an FSAs make paying for personal health simpler, which is great news for fitness brands.

Because the funds are already earmarked for health-related expenses, consumers don’t have to negotiate about how to spend the money — if they find a service they like, such as Trainwell, they can simply use the funds they already have without worrying how they’re going to pay for it.

Stats

1,000 free trial clients opted in to receive HSA/FSA education emails

20% increase in trial conversions for HSA/FSA opt-in group

Flex is the easiest way for direct to consumer brands and retailers to accept HSA/FSA for their products. From fitness and nutrition, to sleep and mental health, Flex takes a holistic view of healthcare and enables consumers to use their pre-tax money to do the same.