HSA/FSA

A Quick Guide to FSA and HSA Approved Exercise Equipment

Learn how you can build a home gym that supports your health and saves you money.

November 17, 2024

Sam O'Keefe

Co-founder & CEO of Flex

Overview

Overview

Overview

Overview

If you’re managing a medical condition, the right fitness routine isn’t just a lifestyle choice — it’s an essential part of your care plan.

And when it comes to sticking to the plan, having exercise equipment at home can make staying active easier and more sustainable. What’s more, if your healthcare provider deems it necessary, some of this equipment might even be eligible for Health Savings Account (HSA) or Flexible Spending Account (FSA) spending.

Read on to learn how you may be able to use your HSA or FSA funds to invest in equipment that helps you meet your health goals from the comfort of home.

What is Exercise Equipment?

The term exercise equipment covers a wide range of devices designed to facilitate physical activity. This includes items like treadmills, stationary bikes, and rowing machines, as well as free weights, resistance bands, or exercise balls, and more specialized pieces like stair climbers or ellipticals.

Having access to exercise equipment at home can provide greater flexibility to work toward your fitness and health goals. This can be especially useful if you’re aiming to treat or manage a specific medical condition.

Specialized at-home exercise equipment, like this Stride-6 Treadmill from Ecehelon Fit, is often designed to pack up and stowaway to let you workout without taking up a lot of space. Source: Ecehelon Fit

Is Exercise Equipment FSA or HSA Approved?

Fitness equipment can be FSA or HSA eligible, but only under certain circumstances.

Generally, home exercise equipment purchased solely for overall fitness and wellbeing isn’t covered by your HSA or FSA However, if the item is considered medically necessary as part of a treatment plan for a specific condition, it may be covered — but only with a Letter of Medical Necessity (LOMN) from a licensed healthcare provider.

This means that you’ll need to:

Consult with your doctor, who will evaluate if exercise equipment is essential for managing or treating your specific health condition.

Obtain a Letter of Medical Necessity (LOMN), which outlines how the equipment will help improve, treat, or maintain your health based on your medical needs.

Without this documentation, exercise equipment typically won’t qualify for HSA or FSA funds. Remember, the purchase must directly support the treatment or management of a medical condition, not just general fitness goals.

Along those lines, is sports equipment HSA or FSA eligible?

Since we’re on the subject of exercise, you might want to know about sports equipment and protective gear for athletic activities. Generally speaking, items that are used to protect from injury, such as mouth guards, heartguard shirts, protective eyewear, and prescription goggles qualify.

However, items for general sports use (like tennis rackets or a volleyball) would not qualify, unless they are part of your treatment plan to address a specific medical condition. As always, consult with your healthcare provider to ensure items are eligible.

What Medical Conditions May Exercise Equipment Be HSA or FSA Approved For?

The scope of medical conditions that may qualify for HSA reimbursement for exercise equipment is pretty broad. Some of the health conditions that might warrant medically necessary exercise equipment include:

Cardiovascular disease: For those with heart disease or hypertension, regular exercise is often recommended to improve heart health and reduce blood pressure levels.

Metabolic syndrome: A group of conditions that together increase your risk of cardiovascular disease, Type 2 diabetes and stroke. Physical activity or an exercise program is typically part of the care plan as it can help increase insulin sensitivity, helps keep your cardiovascular system healthy, and can support weight loss.

Mental health: Exercise and exercise equipment (like yoga mats, balance balls, or treadmills) can help reduce stress and improve mental well-being, which may be part of a prescribed treatment plan for conditions like anxiety, depression, or other stress-related disorders.

Osteoporosis and osteopenia: Weight-bearing exercises (like lifting weights, resistance bands, or walking) can help prevent and even reverse bone-loss conditions and help improve bone density.

Obesity: Exercise equipment may be used as part of a weight management plan for obese patients, helping to manage weight and improve cardiovascular health.

Chronic pain or musculoskeletal disorders: According to the NIH, aerobic and resistance training programs (with tools like exercise balls and hand grips) provide the greatest benefit for chronic pain, like arthritis, back pain, or fibromyalgia.

Diabetes: Regular physical activity is essential for managing blood glucose levels. Exercise equipment, such as an exercise bike or treadmill, can facilitate consistent, safe activity.

Post-surgery and rehabilitation: For those recovering from knee surgery, hip replacement, and the like, exercise equipment such as stationary bikes and resistance bands can be an important part of regaining strength, mobility, and flexibility after surgery.

It’s important to note that general weight loss plans for aesthetic purposes are not eligible for HSA or FSA reimbursement. The equipment must be directly prescribed for health management.

Home fitness equipment, like PowerBlock’s adjustable dumbbells, are a great way to workout at home without taking up a lot of space. Source: PowerBlock

Exercise Your HSA/FSA Funds on Home Gym Game-Changers

Home exercise equipment is a convenient way to maintain your care plan at home — without having to go to the gym — and it may be FSA and HSA-eligible too. We highlight a few HSA and FSA approved brands below:

Echelon Fit

Echelon Fit’s exercise equipment makes it possible to bring the gym experience to your living room when you want (and put it out of the way when you don’t). Known for their smart, connected exercise equipment, including bikes, rowers, and all-in-one home gym machines, Echelon provides access to live and on-demand classes that let’s you stay active in the company of others from the comfort of home.

Can I buy an Echelon Fit exercise bike with HSA or FSA?

An exercise bike, like the ones offered by Echelon Fit, could be a great option if your doctor has recommended cardiovascular exercise to help manage a condition like diabetes or hypertension. With a Letter of Medical Necessity, your HSA could potentially cover the cost, allowing you to create a personalized, convenient cardio routine in your living room. Echelon’s bikes are designed for low-impact exercise, making them suitable for many health conditions that benefit from regular cardiovascular activity.

Aussie Fitness Pros

Aussie Fitness Pros offers a broad selection of exercise equipment, ranging from treadmills to ellipticals to strength-training tools. Known for durability and user-friendly design, their products can be a great choice if you’re aiming for a balanced fitness routine.

Can I buy an Aussie Fitness Pros treadmill with my HSA or FSA?

If your healthcare provider has recommended regular, weight-bearing exercise, treadmills like the Aussie Pro Runner might be eligible for HSA reimbursement. Treadmills are especially beneficial for individuals managing conditions like obesity or high blood pressure because they offer a safe, modifiable, and structured way to build cardiovascular endurance.

PowerBlock

PowerBlock is a leading brand in adjustable dumbbells and other strength-training equipment. Compact, versatile, and easily adjustable, PowerBlock dumbbells can serve as an all-in-one home gym. They allow you to perform a variety of strength exercises with just one set of weights, saving space without compromising on workout quality.

Will my HSA or FSA cover PowerBlock’s dumbbells and workout equipment?

Strength training is often recommended for people with conditions such as osteoporosis or arthritis, as it helps improve bone density, joint stability, and muscle strength. With an LOMN, PowerBlock dumbbells could qualify for HSA/FSA reimbursement, allowing you to incorporate muscle-strengthening exercises into your routine without having to visit a gym.

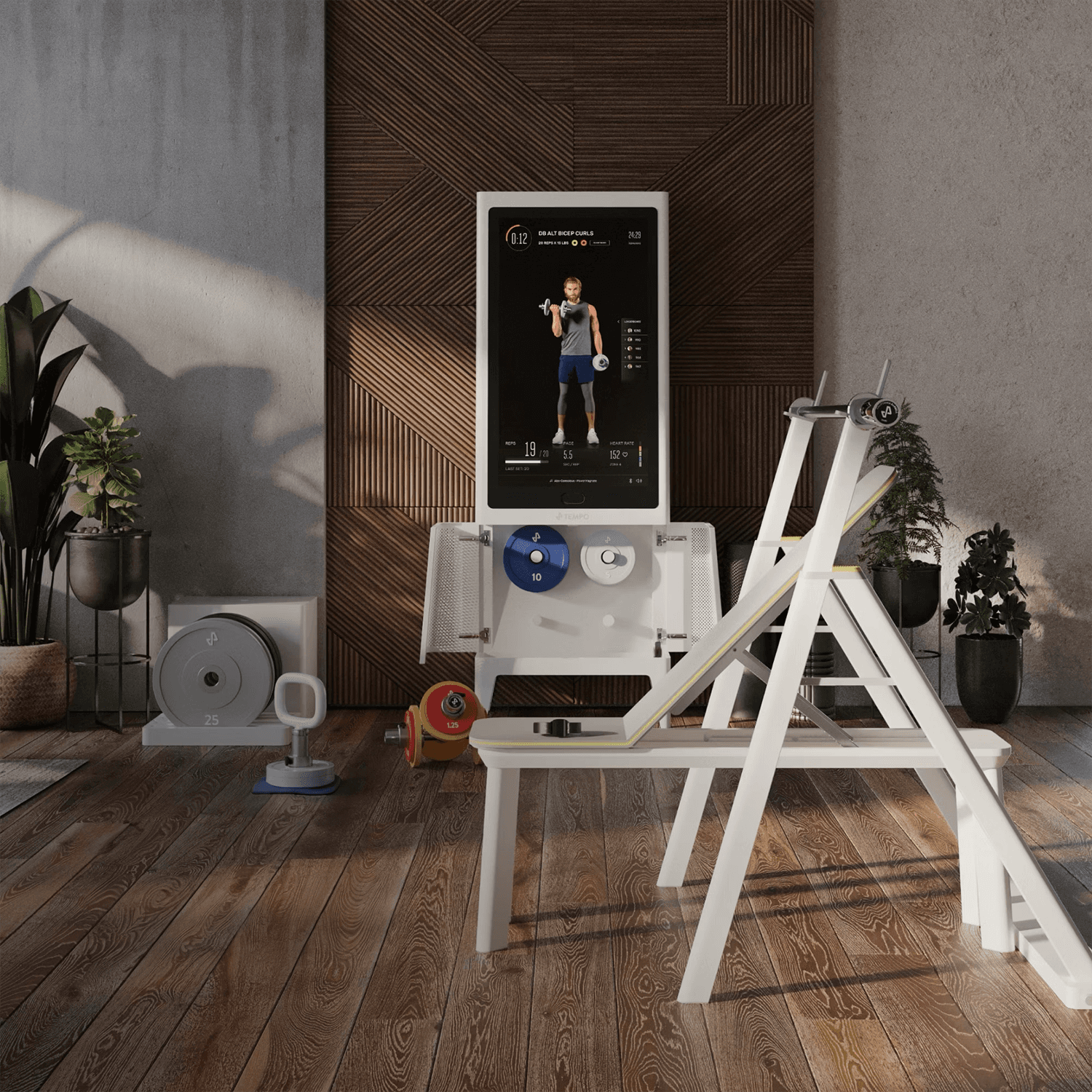

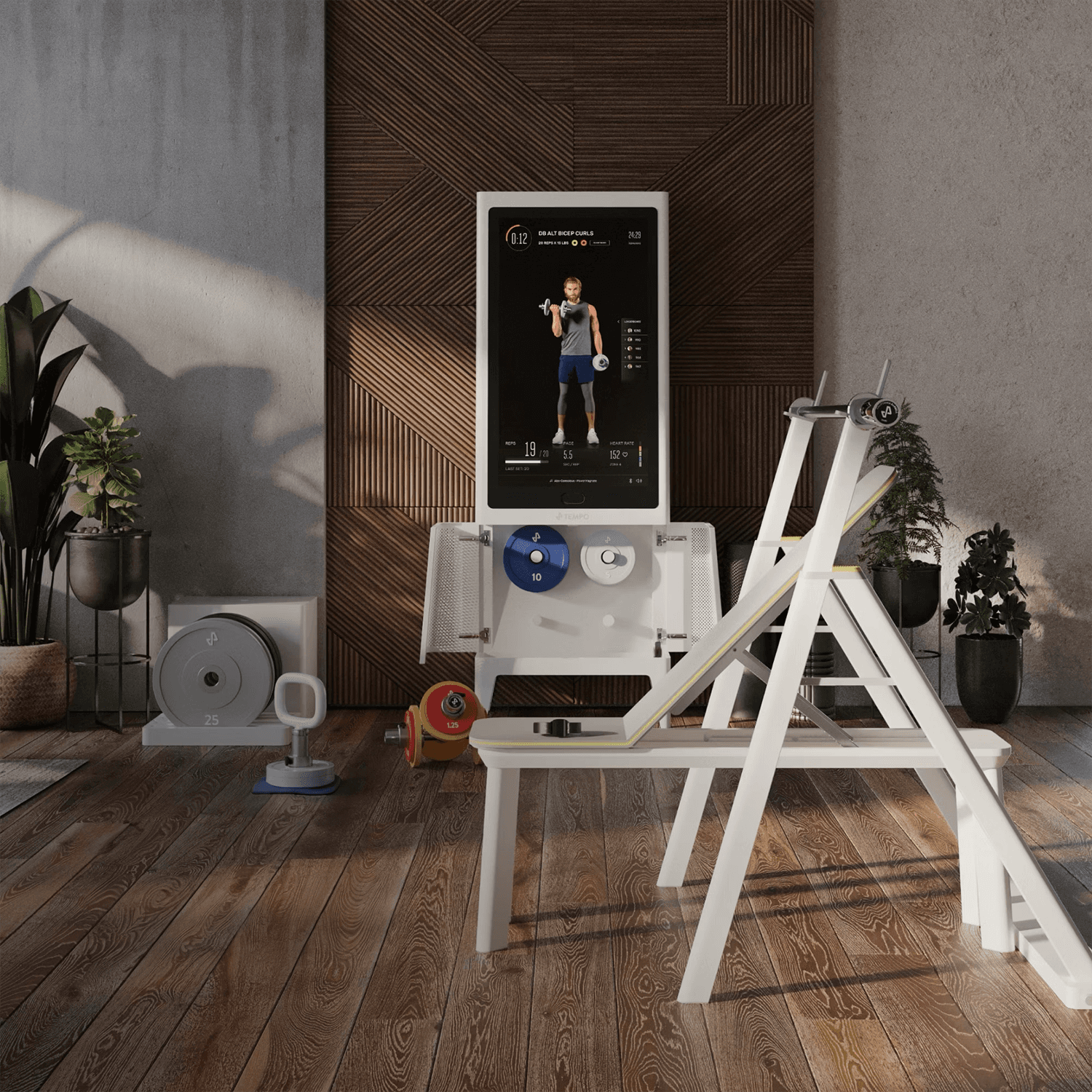

Tempo

Tempo offers a sleek, tech-integrated approach to at-home fitness with their “smart” fitness studio. Their equipment comes with an interactive display, built-in sensors, and AI-driven training programs that help guide you through each movement, providing real-time feedback to ensure safe, effective workouts.

Can my HSA/FSA cover Tempo’s exercise programs?

Tempo’s strength and cardio programs are ideal for those whose healthcare provider has prescribed exercise to improve heart health, manage weight, or build muscle mass. With an LOMN, Tempo’s equipment could be HSA-eligible, which means you could enjoy a high-tech, personalized exercise experience right in your living room!

How Flex Can Help You Pay for FSA and HSA Approved Exercise Equipment

If you’ve received your Letter of Medical Necessity or need to obtain one, Flex can help you pay for your exercise equipment without breaking a sweat:

Step 1: Add the HSA/FSA-eligible exercise equipment you want to your cart

Companies like Echelon Fit, Aussie Fitnes Pros, PowerBlock and Tempo have partnered with Flex to make purchasing their products with HSA/FSA much easier.

Step 2: Select “Flex | Pay with HSA/FSA" at checkout

You can buy these items directly from the companies by selecting “Flex | Pay with HSA/FSA" as your payment option at checkout.

At checkout, Flex will prompt you to fill in a short health questionnaire to confirm your eligibility to pay with your HSA/FSA. You can then use either your HSA/FSA card or pay out-of-pocket with a regular credit or debit card (and receive the required documents to submit for reimbursement via email).

Step 3: Keep documentation

Keep all documentation, including receipts and the Letter of Medical Necessity, for tax purposes and to ensure compliance with IRS regulations.

It’s as easy as that!

Your Path to Health Starts at Home

When exercise becomes part of your medical care, having the right equipment at home can make all the difference. If your healthcare provider backs it up, that treadmill, bike, or set of weights might just be FSA or HSA-approved, which could give you an accessible, effective way to manage your health in your own space.

So, consider talking with your doctor, reviewing your HSA or FSA options, and turning your home into the wellness hub you need. Each workout could bring you closer to your health goals, helping you take charge of your well-being, one rep, step, or pedal stroke at a time.

If you’re managing a medical condition, the right fitness routine isn’t just a lifestyle choice — it’s an essential part of your care plan.

And when it comes to sticking to the plan, having exercise equipment at home can make staying active easier and more sustainable. What’s more, if your healthcare provider deems it necessary, some of this equipment might even be eligible for Health Savings Account (HSA) or Flexible Spending Account (FSA) spending.

Read on to learn how you may be able to use your HSA or FSA funds to invest in equipment that helps you meet your health goals from the comfort of home.

What is Exercise Equipment?

The term exercise equipment covers a wide range of devices designed to facilitate physical activity. This includes items like treadmills, stationary bikes, and rowing machines, as well as free weights, resistance bands, or exercise balls, and more specialized pieces like stair climbers or ellipticals.

Having access to exercise equipment at home can provide greater flexibility to work toward your fitness and health goals. This can be especially useful if you’re aiming to treat or manage a specific medical condition.

Specialized at-home exercise equipment, like this Stride-6 Treadmill from Ecehelon Fit, is often designed to pack up and stowaway to let you workout without taking up a lot of space. Source: Ecehelon Fit

Is Exercise Equipment FSA or HSA Approved?

Fitness equipment can be FSA or HSA eligible, but only under certain circumstances.

Generally, home exercise equipment purchased solely for overall fitness and wellbeing isn’t covered by your HSA or FSA However, if the item is considered medically necessary as part of a treatment plan for a specific condition, it may be covered — but only with a Letter of Medical Necessity (LOMN) from a licensed healthcare provider.

This means that you’ll need to:

Consult with your doctor, who will evaluate if exercise equipment is essential for managing or treating your specific health condition.

Obtain a Letter of Medical Necessity (LOMN), which outlines how the equipment will help improve, treat, or maintain your health based on your medical needs.

Without this documentation, exercise equipment typically won’t qualify for HSA or FSA funds. Remember, the purchase must directly support the treatment or management of a medical condition, not just general fitness goals.

Along those lines, is sports equipment HSA or FSA eligible?

Since we’re on the subject of exercise, you might want to know about sports equipment and protective gear for athletic activities. Generally speaking, items that are used to protect from injury, such as mouth guards, heartguard shirts, protective eyewear, and prescription goggles qualify.

However, items for general sports use (like tennis rackets or a volleyball) would not qualify, unless they are part of your treatment plan to address a specific medical condition. As always, consult with your healthcare provider to ensure items are eligible.

What Medical Conditions May Exercise Equipment Be HSA or FSA Approved For?

The scope of medical conditions that may qualify for HSA reimbursement for exercise equipment is pretty broad. Some of the health conditions that might warrant medically necessary exercise equipment include:

Cardiovascular disease: For those with heart disease or hypertension, regular exercise is often recommended to improve heart health and reduce blood pressure levels.

Metabolic syndrome: A group of conditions that together increase your risk of cardiovascular disease, Type 2 diabetes and stroke. Physical activity or an exercise program is typically part of the care plan as it can help increase insulin sensitivity, helps keep your cardiovascular system healthy, and can support weight loss.

Mental health: Exercise and exercise equipment (like yoga mats, balance balls, or treadmills) can help reduce stress and improve mental well-being, which may be part of a prescribed treatment plan for conditions like anxiety, depression, or other stress-related disorders.

Osteoporosis and osteopenia: Weight-bearing exercises (like lifting weights, resistance bands, or walking) can help prevent and even reverse bone-loss conditions and help improve bone density.

Obesity: Exercise equipment may be used as part of a weight management plan for obese patients, helping to manage weight and improve cardiovascular health.

Chronic pain or musculoskeletal disorders: According to the NIH, aerobic and resistance training programs (with tools like exercise balls and hand grips) provide the greatest benefit for chronic pain, like arthritis, back pain, or fibromyalgia.

Diabetes: Regular physical activity is essential for managing blood glucose levels. Exercise equipment, such as an exercise bike or treadmill, can facilitate consistent, safe activity.

Post-surgery and rehabilitation: For those recovering from knee surgery, hip replacement, and the like, exercise equipment such as stationary bikes and resistance bands can be an important part of regaining strength, mobility, and flexibility after surgery.

It’s important to note that general weight loss plans for aesthetic purposes are not eligible for HSA or FSA reimbursement. The equipment must be directly prescribed for health management.

Home fitness equipment, like PowerBlock’s adjustable dumbbells, are a great way to workout at home without taking up a lot of space. Source: PowerBlock

Exercise Your HSA/FSA Funds on Home Gym Game-Changers

Home exercise equipment is a convenient way to maintain your care plan at home — without having to go to the gym — and it may be FSA and HSA-eligible too. We highlight a few HSA and FSA approved brands below:

Echelon Fit

Echelon Fit’s exercise equipment makes it possible to bring the gym experience to your living room when you want (and put it out of the way when you don’t). Known for their smart, connected exercise equipment, including bikes, rowers, and all-in-one home gym machines, Echelon provides access to live and on-demand classes that let’s you stay active in the company of others from the comfort of home.

Can I buy an Echelon Fit exercise bike with HSA or FSA?

An exercise bike, like the ones offered by Echelon Fit, could be a great option if your doctor has recommended cardiovascular exercise to help manage a condition like diabetes or hypertension. With a Letter of Medical Necessity, your HSA could potentially cover the cost, allowing you to create a personalized, convenient cardio routine in your living room. Echelon’s bikes are designed for low-impact exercise, making them suitable for many health conditions that benefit from regular cardiovascular activity.

Aussie Fitness Pros

Aussie Fitness Pros offers a broad selection of exercise equipment, ranging from treadmills to ellipticals to strength-training tools. Known for durability and user-friendly design, their products can be a great choice if you’re aiming for a balanced fitness routine.

Can I buy an Aussie Fitness Pros treadmill with my HSA or FSA?

If your healthcare provider has recommended regular, weight-bearing exercise, treadmills like the Aussie Pro Runner might be eligible for HSA reimbursement. Treadmills are especially beneficial for individuals managing conditions like obesity or high blood pressure because they offer a safe, modifiable, and structured way to build cardiovascular endurance.

PowerBlock

PowerBlock is a leading brand in adjustable dumbbells and other strength-training equipment. Compact, versatile, and easily adjustable, PowerBlock dumbbells can serve as an all-in-one home gym. They allow you to perform a variety of strength exercises with just one set of weights, saving space without compromising on workout quality.

Will my HSA or FSA cover PowerBlock’s dumbbells and workout equipment?

Strength training is often recommended for people with conditions such as osteoporosis or arthritis, as it helps improve bone density, joint stability, and muscle strength. With an LOMN, PowerBlock dumbbells could qualify for HSA/FSA reimbursement, allowing you to incorporate muscle-strengthening exercises into your routine without having to visit a gym.

Tempo

Tempo offers a sleek, tech-integrated approach to at-home fitness with their “smart” fitness studio. Their equipment comes with an interactive display, built-in sensors, and AI-driven training programs that help guide you through each movement, providing real-time feedback to ensure safe, effective workouts.

Can my HSA/FSA cover Tempo’s exercise programs?

Tempo’s strength and cardio programs are ideal for those whose healthcare provider has prescribed exercise to improve heart health, manage weight, or build muscle mass. With an LOMN, Tempo’s equipment could be HSA-eligible, which means you could enjoy a high-tech, personalized exercise experience right in your living room!

How Flex Can Help You Pay for FSA and HSA Approved Exercise Equipment

If you’ve received your Letter of Medical Necessity or need to obtain one, Flex can help you pay for your exercise equipment without breaking a sweat:

Step 1: Add the HSA/FSA-eligible exercise equipment you want to your cart

Companies like Echelon Fit, Aussie Fitnes Pros, PowerBlock and Tempo have partnered with Flex to make purchasing their products with HSA/FSA much easier.

Step 2: Select “Flex | Pay with HSA/FSA" at checkout

You can buy these items directly from the companies by selecting “Flex | Pay with HSA/FSA" as your payment option at checkout.

At checkout, Flex will prompt you to fill in a short health questionnaire to confirm your eligibility to pay with your HSA/FSA. You can then use either your HSA/FSA card or pay out-of-pocket with a regular credit or debit card (and receive the required documents to submit for reimbursement via email).

Step 3: Keep documentation

Keep all documentation, including receipts and the Letter of Medical Necessity, for tax purposes and to ensure compliance with IRS regulations.

It’s as easy as that!

Your Path to Health Starts at Home

When exercise becomes part of your medical care, having the right equipment at home can make all the difference. If your healthcare provider backs it up, that treadmill, bike, or set of weights might just be FSA or HSA-approved, which could give you an accessible, effective way to manage your health in your own space.

So, consider talking with your doctor, reviewing your HSA or FSA options, and turning your home into the wellness hub you need. Each workout could bring you closer to your health goals, helping you take charge of your well-being, one rep, step, or pedal stroke at a time.

Flex is the easiest way for direct to consumer brands and retailers to accept HSA/FSA for their products. From fitness and nutrition, to sleep and mental health, Flex takes a holistic view of healthcare and enables consumers to use their pre-tax money to do the same.