Personal Care

Tastermonial

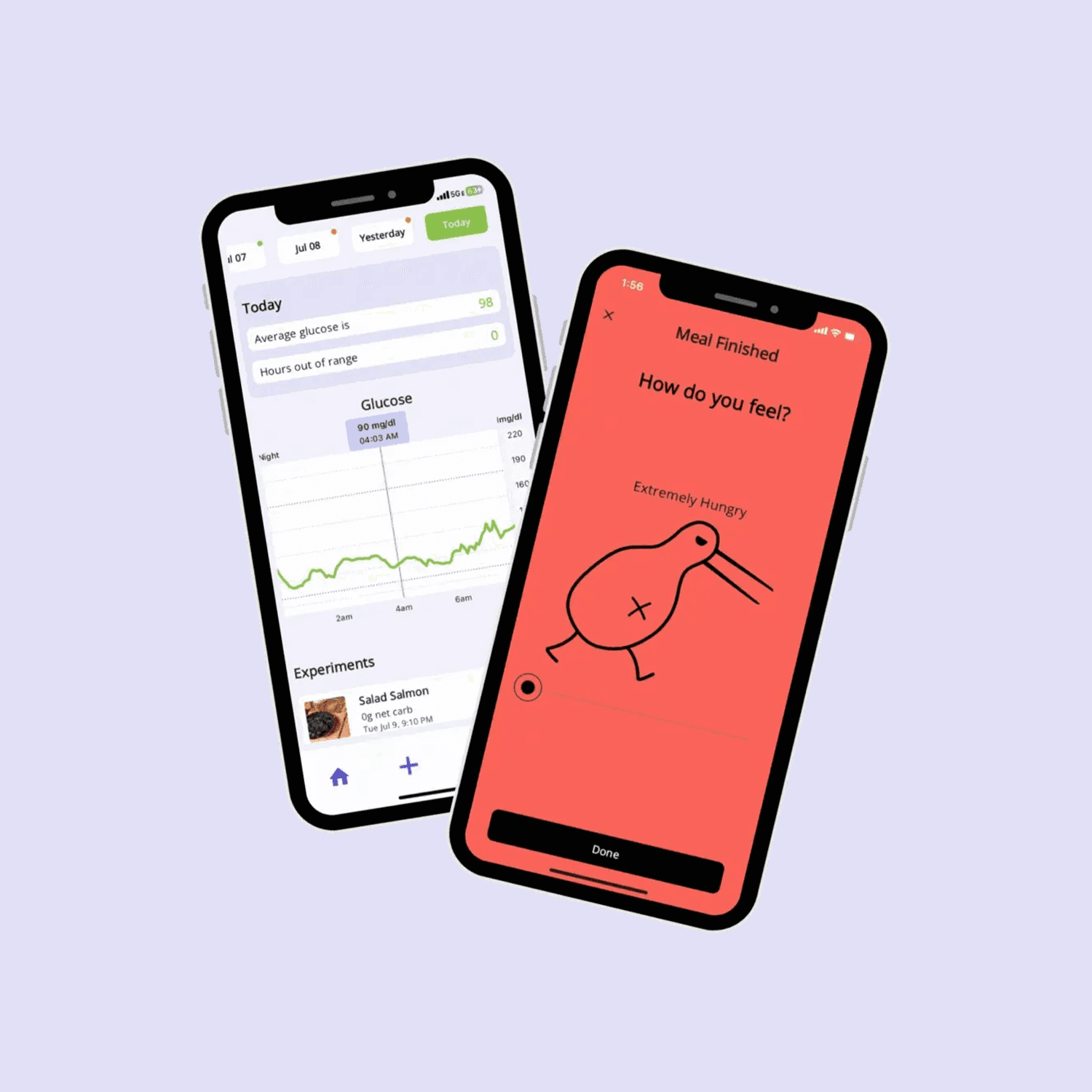

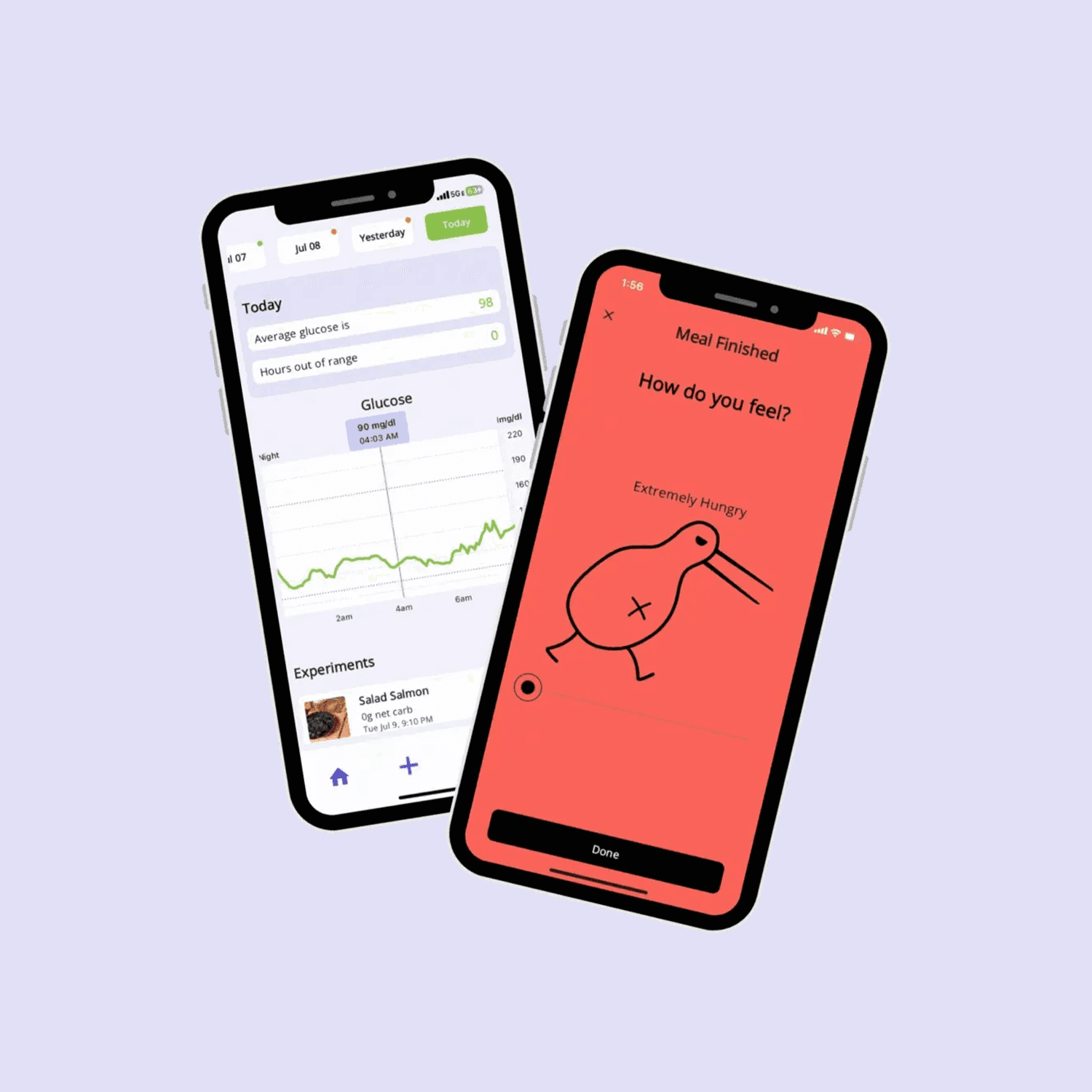

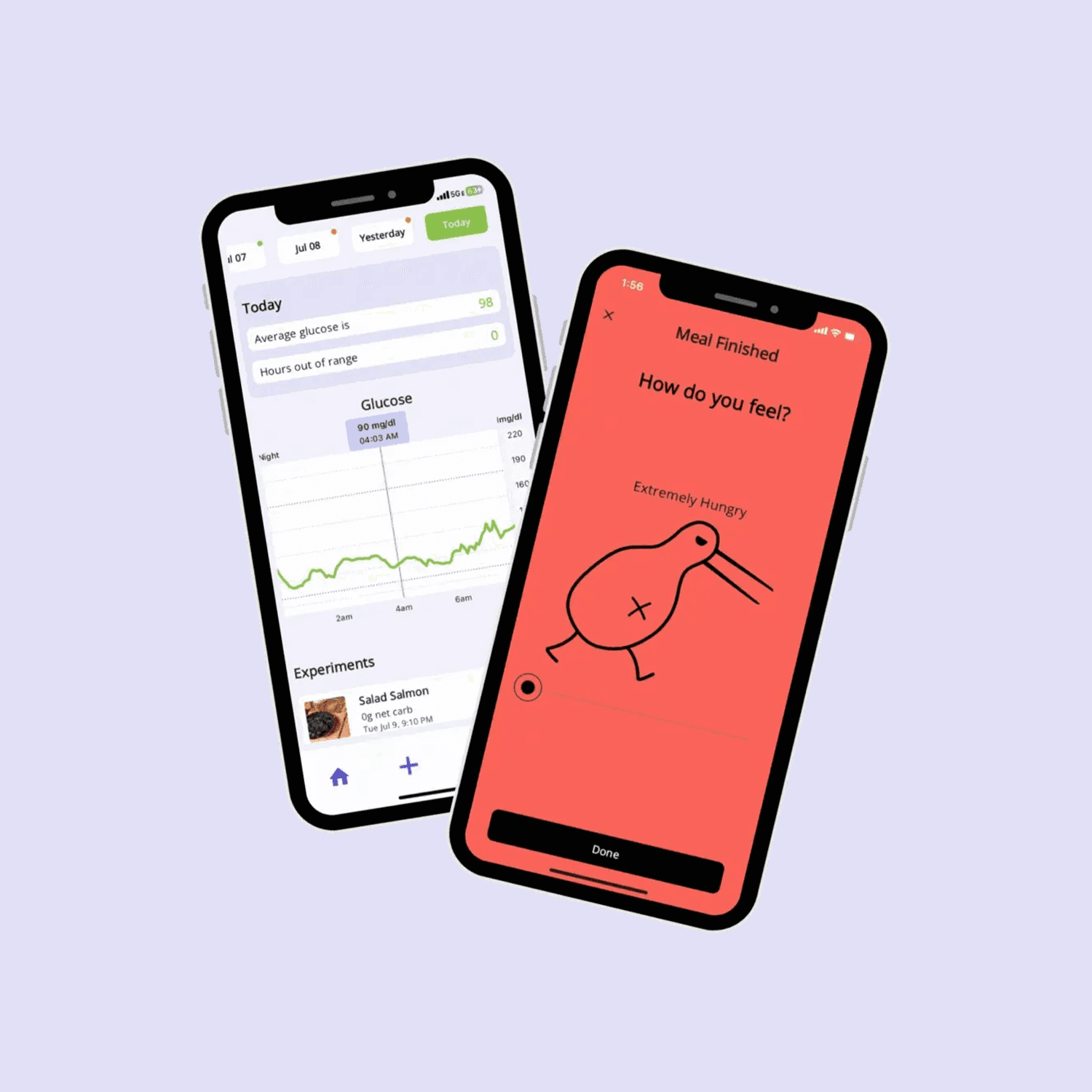

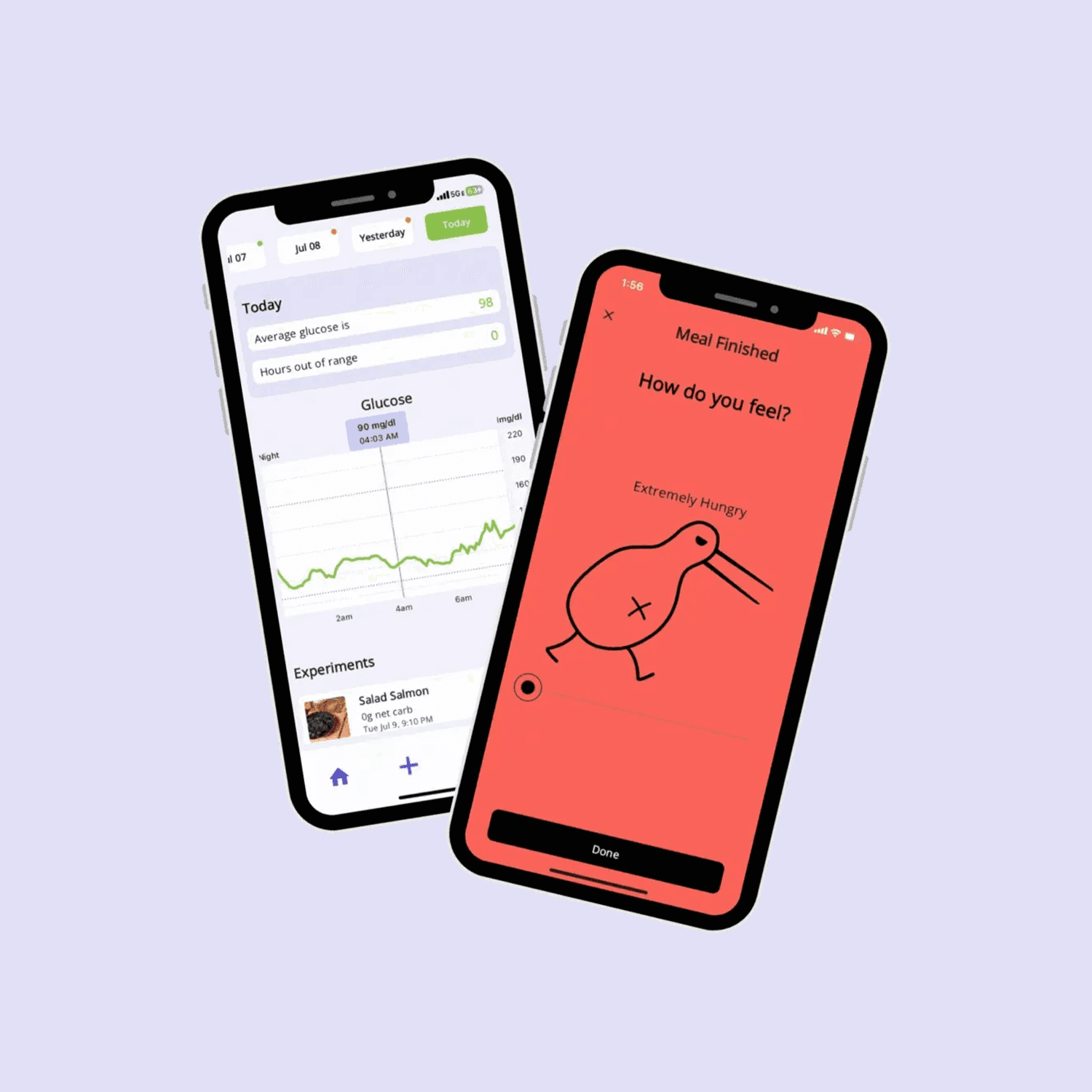

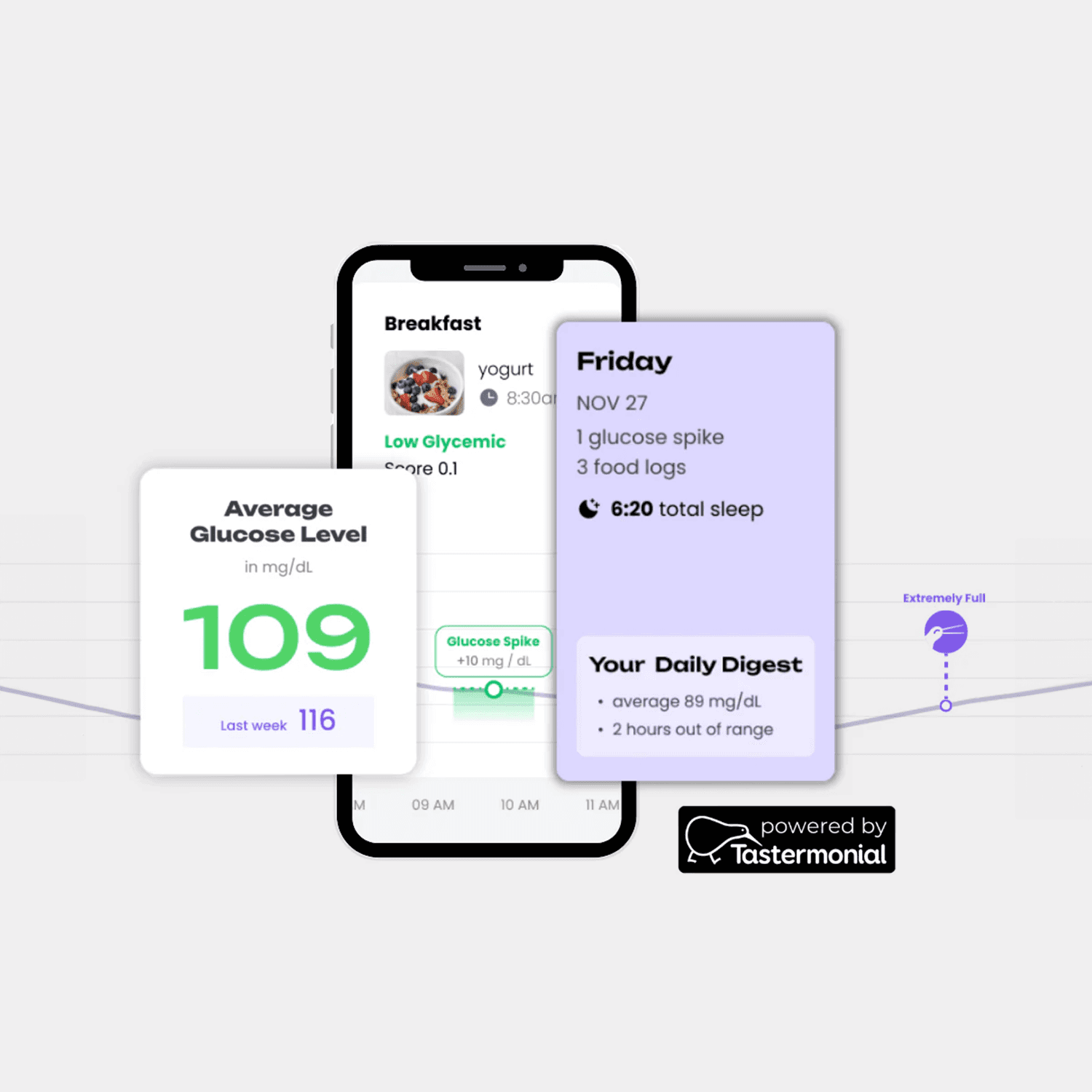

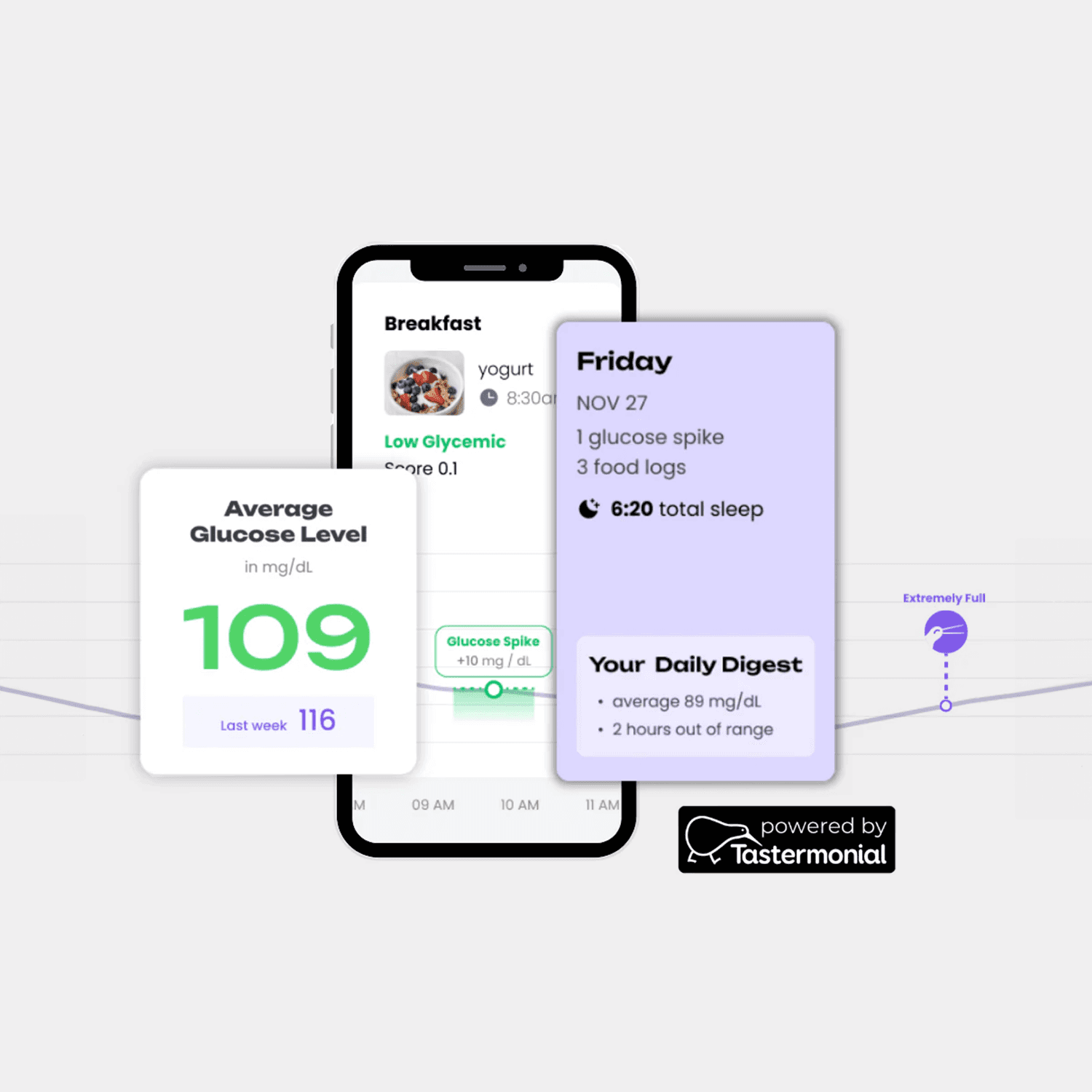

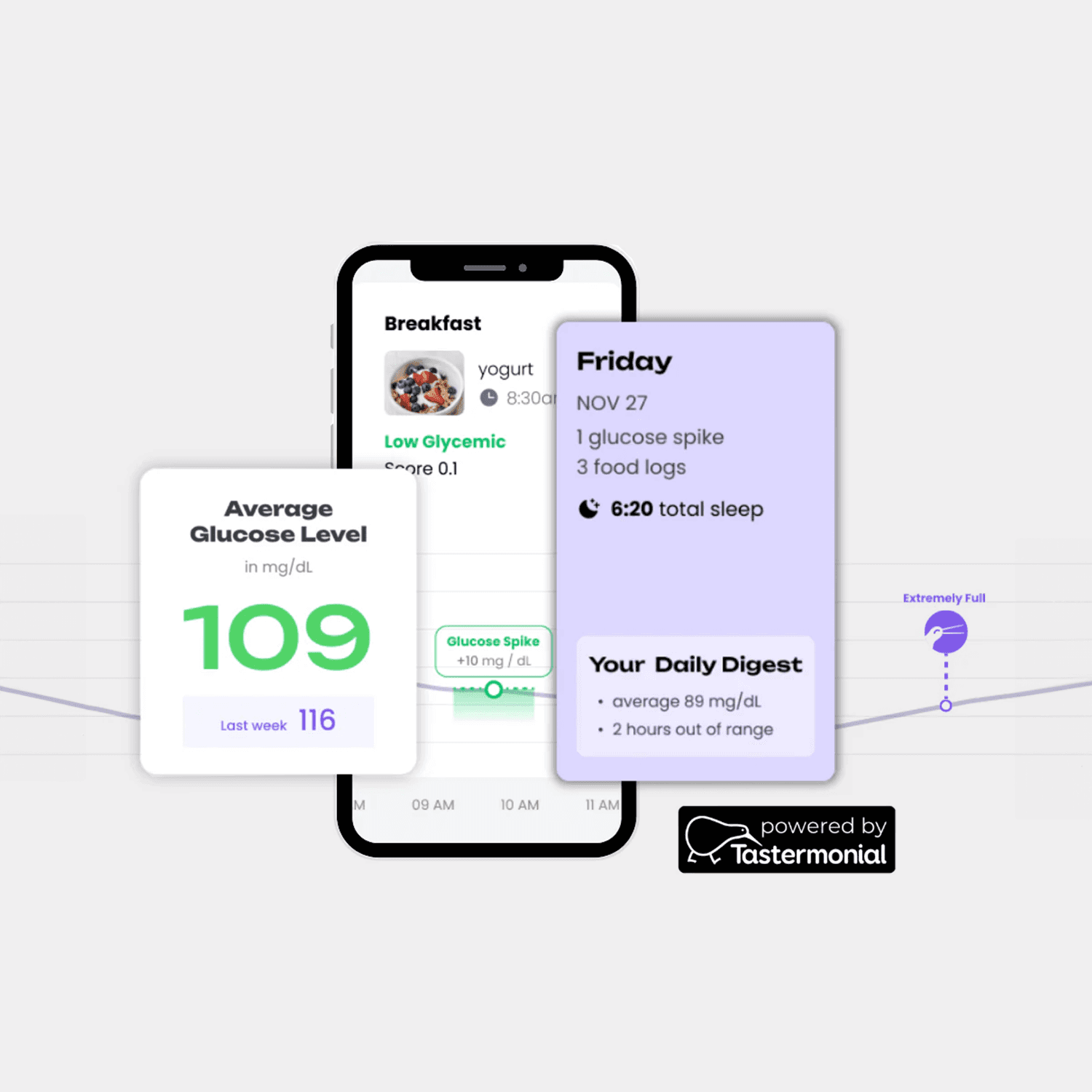

Don't guess. Just test. Dive into the world of low glycemic foods and start experimenting with steady energy and fewer cravings!

Tastermonial

Tastermonial

Tastermonial

Tastermonial

SELECT FLEX AT CHECKOUT

SELECT FLEX AT CHECKOUT

SELECT FLEX AT CHECKOUT

How to use your HSA/FSA

How to use your HSA/FSA

How to use your HSA/FSA

Visit Tastermonial and follow the instructions below to use your HSA/FSA and save using pre-tax dollars.

Visit Tastermonial and follow the instructions below to use your HSA/FSA and save using pre-tax dollars.

Visit Tastermonial and follow the instructions below to use your HSA/FSA and save using pre-tax dollars.

Credit card

PayPal

Pay in full or in installments

Flex | Pay with HSA/FSA

Credit card

PayPal

Pay in full or in installments

Flex | Pay with HSA/FSA

Credit card

PayPal

Pay in full or in installments

Flex | Pay with HSA/FSA

1

Select: Flex | Pay with HSA/FSA

If Flex isn’t shown, check out as a guest to see all payment options.

2

Complete a 2 minute consultation

A doctor will verify your eligibility in a text-based consultation—no video required.

3

Use your HSA/FSA card for 30-40% savings

Don’t have your card handy? Flex will guide you through the reimbursement process.

EXPLORE MORE BY Tastermonial

EXPLORE MORE BY Tastermonial

EXPLORE MORE BY Tastermonial

Featured product

Featured product

Featured product

You can save 30-40% by using your HSA/FSA funds.

You can save 30-40% by using your HSA/FSA funds.

You can save 30-40% by using your HSA/FSA funds.

STARTING AT $79.00

CGM Baseline Glycemic Test Plan

Our baseline test kit helps you track how your body processes glucose from different food, giving you useful insights into your metabolic health. This kit provides convenient tools to stay informed about your glucose levels and overall wellness.

LEARN MORE

LEARN MORE

LEARN MORE

Frequently asked questions

Frequently asked questions

Frequently asked questions

If you can’t find what you’re looking for, please reach out to support@withflex.com

If you can’t find what you’re looking for, please reach out to support@withflex.com

If you can’t find what you’re looking for, please reach out to support@withflex.com

What’s an HSA or FSA?

Health Savings Accounts (HSAs) let you set aside pre-tax dollars to pay for qualified health expenses. HSAs are linked to high-deductible health plans, and funds in these accounts roll over year after year.

Flexible Spending Accounts (FSAs) allow you to use pre-tax dollars for eligible health expenses. Unlike HSAs, FSAs are not tied to a specific health plan and often require you to use the funds within the calendar year. FSAs are typically provided by employers.

What’s an HSA or FSA?

Health Savings Accounts (HSAs) let you set aside pre-tax dollars to pay for qualified health expenses. HSAs are linked to high-deductible health plans, and funds in these accounts roll over year after year.

Flexible Spending Accounts (FSAs) allow you to use pre-tax dollars for eligible health expenses. Unlike HSAs, FSAs are not tied to a specific health plan and often require you to use the funds within the calendar year. FSAs are typically provided by employers.

What’s a Letter of Medical Necessity?

A Letter of Medical Necessity is a document from a licensed healthcare provider that verifies the medical necessity of a product or service, making it eligible to purchase using your HSA or FSA. This might include items or treatments like supplements or physical therapy that aren’t automatically recognized as eligible expenses.

What’s a Letter of Medical Necessity?

A Letter of Medical Necessity is a document from a licensed healthcare provider that verifies the medical necessity of a product or service, making it eligible to purchase using your HSA or FSA. This might include items or treatments like supplements or physical therapy that aren’t automatically recognized as eligible expenses.

Am I eligible for a Letter of Medical Necessity?

A licensed clinician will determine your eligibility during a chat-based telehealth consultation. According to IRS guidelines, you must have a medical condition that warrants the product or service you intend to purchase using your HSA/FSA. A range of conditions—such as cardiovascular, metabolic, musculoskeletal, autoimmune, neurological, or mental health conditions—could qualify.

Am I eligible for a Letter of Medical Necessity?

A licensed clinician will determine your eligibility during a chat-based telehealth consultation. According to IRS guidelines, you must have a medical condition that warrants the product or service you intend to purchase using your HSA/FSA. A range of conditions—such as cardiovascular, metabolic, musculoskeletal, autoimmune, neurological, or mental health conditions—could qualify.

How long is my Letter of Medical Necessity valid for?

Your Letter of Medical Necessity is valid for 12 months from the date of issue. It can be used for any eligible purchases made during this time. Be sure to keep and submit all related receipts when filing with your HSA/FSA administrator.

How long is my Letter of Medical Necessity valid for?

Your Letter of Medical Necessity is valid for 12 months from the date of issue. It can be used for any eligible purchases made during this time. Be sure to keep and submit all related receipts when filing with your HSA/FSA administrator.

How do I use my HSA/FSA with Tastermonial?

At checkout, select "Flex | Pay with HSA/FSA."

Complete a brief chat-based telehealth consultation to confirm eligibility.

If eligible, enter your HSA/FSA card details and complete your purchase.

If you don’t have your HSA/FSA card available, use a regular credit or debit card. Submit your Letter of Medical Necessity and itemized receipt (provided by Flex) to your HSA/FSA administrator for reimbursement.

How do I use my HSA/FSA with Tastermonial?

At checkout, select "Flex | Pay with HSA/FSA."

Complete a brief chat-based telehealth consultation to confirm eligibility.

If eligible, enter your HSA/FSA card details and complete your purchase.

If you don’t have your HSA/FSA card available, use a regular credit or debit card. Submit your Letter of Medical Necessity and itemized receipt (provided by Flex) to your HSA/FSA administrator for reimbursement.

When will I receive my Letter of Medical Necessity?

You’ll receive your Letter of Medical Necessity on the same day as your consultation, often within a few hours.

When will I receive my Letter of Medical Necessity?

You’ll receive your Letter of Medical Necessity on the same day as your consultation, often within a few hours.

When will I receive my itemized receipt?

When you complete your purchase with Flex, your itemized receipt will be sent immediately after checkout.

When will I receive my itemized receipt?

When you complete your purchase with Flex, your itemized receipt will be sent immediately after checkout.

How much will I save using my HSA/FSA funds?

Using HSA/FSA funds reduces the amount of income tax you pay, effectively lowering the cost of health-related purchases by using pre-tax dollars. Most consumers save between 30–40%, depending on their tax bracket.

How much will I save using my HSA/FSA funds?

Using HSA/FSA funds reduces the amount of income tax you pay, effectively lowering the cost of health-related purchases by using pre-tax dollars. Most consumers save between 30–40%, depending on their tax bracket.