HSA/FSA

What Are HSAs and FSAs? A Comprehensive Guide

Flex is here to help you understand all the most important aspects of HSAs and FSAs so you can make the right decisions for your health and finances.

February 21, 2024

Sam O'Keefe

Co-founder & CEO of Flex

Overview

Overview

Overview

Overview

Imagine you could reduce the cost of your out-of-pocket medical expenses and take advantage of tax benefits all at the same time? What if you could use funds designated for health on fitness, nutrition, or even sleep products or services that actually improve your health for the long term, instead of only treating the symptoms of illness?

Enter HSAs and FSAs. These are tax-advantaged savings accounts that help you to pay for common healthcare expenses or to be proactive about choosing products or services that address a specific medical condition which insurance might not cover.

If you're feeling confused or overwhelmed trying to understand HSA and FSAs, you’re not alone! Sixty-five percent of Americans struggle with the basic benefits and differences between these accounts. Flex is here to help you understand all the most important aspects of HSAs and FSAs so you can make the right decisions for your health and finances.

What Is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged financial account set up exclusively for health-related expenses. It is not health insurance, but rather a complementary savings account that lets you put money away for medical fees while also reducing your taxable income.

To qualify, you must be enrolled in a high-deductible health plan (HDHP). Because these types of health insurance plans have cheaper premiums but higher out-of-pocket expenses, HSAs can help reduce your costs and round out your coverage.

When used effectively, HSAs can serve as your golden ticket to pre-tax contributions, potential investment gains, and a treasure chest of tax-free withdrawals for qualified medical expenses!

What is the Difference Between an HSA/FSA and a Regular Insurance Plan:

HSAs and FSAs are not insurance policies. Instead, they serve as dedicated accounts for healthcare expenses not covered by your insurance.

The big idea is that they work together to give consumers more choice in their healthcare because you can be more selective about where and how to spend your money.

Why Should You Open an HSA or FSA?

So what’s the benefit of having an HSA or FSA? If you have health insurance, why would you need this?

The long and short of it is that HSAs and FSAs can help you save money. On average, consumers save 30 to 40% percent on purchases they make with their HSA/FSA. In real money terms, by using an HSA, the average person could save $955 on taxes in a single year and up to $1,909 for the whole family.

With an HDHP, consumers can pay more before they reach their deductible, so HSAs and FSAs can help cover out-of-pocket expenses until the maximum is reached.

Beyond this, your insurance may be limited in the scope of products or services it will cover so you will always have some amount of out-of-pocket expenses. Those could include common things like copays, prescriptions, or vision care to preventative medicine products or services like metabolic testing, fitness trackers, and nutrition counseling… as long as they meet the criteria of treatment, prevention, or mitigation of a specific medical condition.

Lastly, it is common for employers to have a contribution match for HSAs, which means free money in your account.

HSAs’ Triple Tax Advantage — What Are the Tax Benefits?

The beauty of HSAs lies in their triple tax advantage. In short:

Contributions are tax-deductible

Growth within the account is tax-free, and

Withdrawals for qualified medical expenses are tax-free

So, not only do you save on income tax, but you can invest your HSA money in a variety of investment tools (including mutual funds, stocks, bonds, ETFS, and CDs) for returns that are tax-free. This allows you to potentially grow your healthcare savings over the long term.

This triple tax benefit makes HSAs an awesome financial planning tool. Talk about a win-win-win.

How to open an HSA:

In order to open an HSA, you need to have a high deductible health plan, or HDHP. For a health plan to qualify as high deductible, it must have a deductible of at least $1,600 for an individual plan or $3,200 for a family plan in 2024.

Unfortunately, you cannot open an HSA while on Medicare or if you’re claimed as a dependent on someone else's tax return.

HSAs are most commonly offered along with your healthcare plan through your employer but they don’t have to be. If you purchased an HDHP on the open market, for example, you could go directly to an HSA provider and open an account directly. Several of the largest providers are Lively, HealthEquity, and Fidelity.

Opening an HSA is straightforward:

Check if you qualify for an HSA

Choose an HSA provider

Gather your personal info - social security number, contact details, and employment information

Choose between individual and family coverage

Open the account, put the funds in and… voila!

When you open an HSA or FSA, you’ll most likely receive a debit card which allows you to purchase eligible items directly. Alternatively, you can collect receipts from eligible purchases and submit them to your account provider for reimbursement.

Can anyone open an HSA?

Sadly, not everyone has access to an HSA. To qualify, you must be covered by a high-deductible health plan, not be enrolled in Medicare, and you cannot be claimed as a dependent on someone else's tax return.

How to set up an HSA if you are self-employed:

Self-employed folks can also sign up for an HSA. You just need to select an HSA-eligible HDHP and open an HSA through the financial institution of your choice. Contributions can be made on a pre-tax basis, lowering your taxable income, and can be used as a tax investment tool.

How do HSA Contributions and Withdrawals Work?

HSAs are an account that you own (unlike Flexible Spending Accounts, which we cover below), which means that if you change jobs or retire it’s still yours. When it comes to using it, though, here are the 5 main rules you need to know:

Review what qualifies as a qualified medical expense: HSAs are designed for qualified medical expenses which the IRS says “must be primarily to alleviate or prevent a physical or mental disability or illness.” The link has a comprehensive list of approved items. However, you can also pay for items that aren’t pre-approved if you receive a Letter of Medical Necessity from a healthcare professional (more on this below). Either way, keep receipts handy for documentation.

You can withdraw at any time: The flexibility of HSAs shines as you can withdraw funds at any time. There's no rush; your HSA is a long-term companion for healthcare needs.

Post-65 flexibility: Once you hit 65, the game changes. While you can still use HSA funds for medical expenses tax-free, non-medical expenses become fair game without the usual 20% penalty.

Non-qualified expenses before 65: Withdrawals for non-qualified expenses before the age of 65 incur income tax plus a 20% penalty.

Reimbursement timing: HSAs don't mandate immediate reimbursement. You can pay out of pocket, let your HSA funds grow through investments, and reimburse yourself later for qualified expenses.

What are the HSA contribution limits for 2024:

As of 2024, the annual HSA contribution limit for individuals is $4,150, and $8,300 for families. These change on a yearly basis, though, so stay informed about any potential updates.

Can employers contribute to my HSA?

Yes, employers can contribute to your HSA, which could enhance your savings even further. Just remember that the rules still apply: Your combined contributions can't exceed the annual contribution limit.

How much should I contribute to my HSA?

As much as you can without breaking the bank, or exceeding the IRS limits. Your HSA sweet spot depends on various factors, including your health expenses, financial situation, and future healthcare needs, which are always a guess. Nailing the balance is crucial to maximize the benefits of your HSA.

HSA Withdrawal Rules and Guidelines:

HSA withdrawals are not that complex, but there is still some finessing to be done. Read on for more details.

Can I withdraw the funds from my HSA at any time?

Yes, you can withdraw funds from your HSA at any time. However, if the withdrawals are not for qualified medical expenses, they will be subject to income tax and a 20% penalty for individuals under 65.

What Is the penalty if you use funds for non-qualified expenses?

Using HSA funds for non-qualified expenses before the age of 65 will net you a 20% withdrawal penalty on top of regular income tax.

The withdrawn amount for non-qualified expenses will generally be included in your taxable income for the year in which the withdrawal occurred. This means you'll need to report the distribution on your income tax return, and it will be subject to your regular income tax rate.

Once you hit 65, you can make withdrawals from your HSA for any reason without incurring the 20% penalty. However, if the withdrawals are not used for qualified medical expenses, they’ll still be subject to regular income tax.

Do HSA Funds Expire?

No, HSA funds do not expire. Unlike some FSAs, your HSA balance carries over from year to year, allowing you to accumulate savings for future healthcare needs.

Some Common Questions About HSAs:

Can I Have an HSA and Medicare?

If you were enrolled in an HSA before going on Medicare, you can keep your account. However, you can't contribute to the HSA after going on Medicare. You can still use existing HSA funds for qualified medical expenses, though.

Can my spouse use my HSA?

Yes, your spouse can use the HSA funds for their qualified medical expenses, even if they are not covered by the same HDHP.

HSA vs HRA: What's the difference?

Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs) are both tools to help you with healthcare expenses, but they differ in structure and how contributions and withdrawals are managed. The disparity is that HRAs are employer-funded accounts, while HSAs can be funded by both employers and individuals.

Is an HSA worth it?

Absolutely! The triple tax advantage, flexible contributions, and tax-free withdrawals for medical expenses make it a star player in your financial lineup. It's not just about saving on taxes; it's about taking control of your healthcare dollars.

If you're a savvy spender, enjoy tax breaks, and want a savings account that grows with you, the HSA can be your financial MVP. It's worth it for the peace of mind, the potential for growth, and the freedom to shape your financial future.

Now onto another popular savings account, the FSA.

What is an FSA?

Flexible Spending Accounts (FSAs) are employer-sponsored benefit plans that let you set aside pre-tax money from your paycheck to cover healthcare and dependent care expenses.

In this article, will be focusing on the healthcare kind.

How Does FSA Work?

Your Healthcare FSA is a budgeting wizard. You decide how much money to contribute pre-tax annually, and it's deducted from your paycheck. By doing this, you are creating a stash that can be tapped for various qualified medical expenses, providing you with tax savings.

What are the benefits of an FSA?

FSA benefits include tax savings, flexibility in healthcare spending, and a lower taxable income. Plus, unlike HSAs, there is no requirement for a high deductible health plan (HDHP).

How to open an FSA

Opening an FSA is typically a breeze through your employer during open enrollment:

Confirm if FSA is in your employer’s benefits package.

Determine the contribution amount and contribute as much as you want during the open enrollment period.

Read through your FSA plan rules and complete the enrollment forms.

It’s as easy as that!

How do FSA contributions and withdrawals work?

You determine your contributions before the plan year begins. For 2024, the FSA contribution limit is up to $3,200. Then, if you need to finance a medical procedure, examination, or any other qualified expense, just dip into the fund!

While FSAs offer significant advantages, they typically come with a "use it or lose it" rule. Most FSA funds not used by the end of the plan year are forfeited, although your boss may offer a grace period or a limited rollover option.

Is an FSA Worth It?

If you have predictable medical expenses, the tax savings alone make an FSA a worthwhile financial ally. Just be mindful of the use-it-or-lose-it aspect when planning how much money to invest in it.

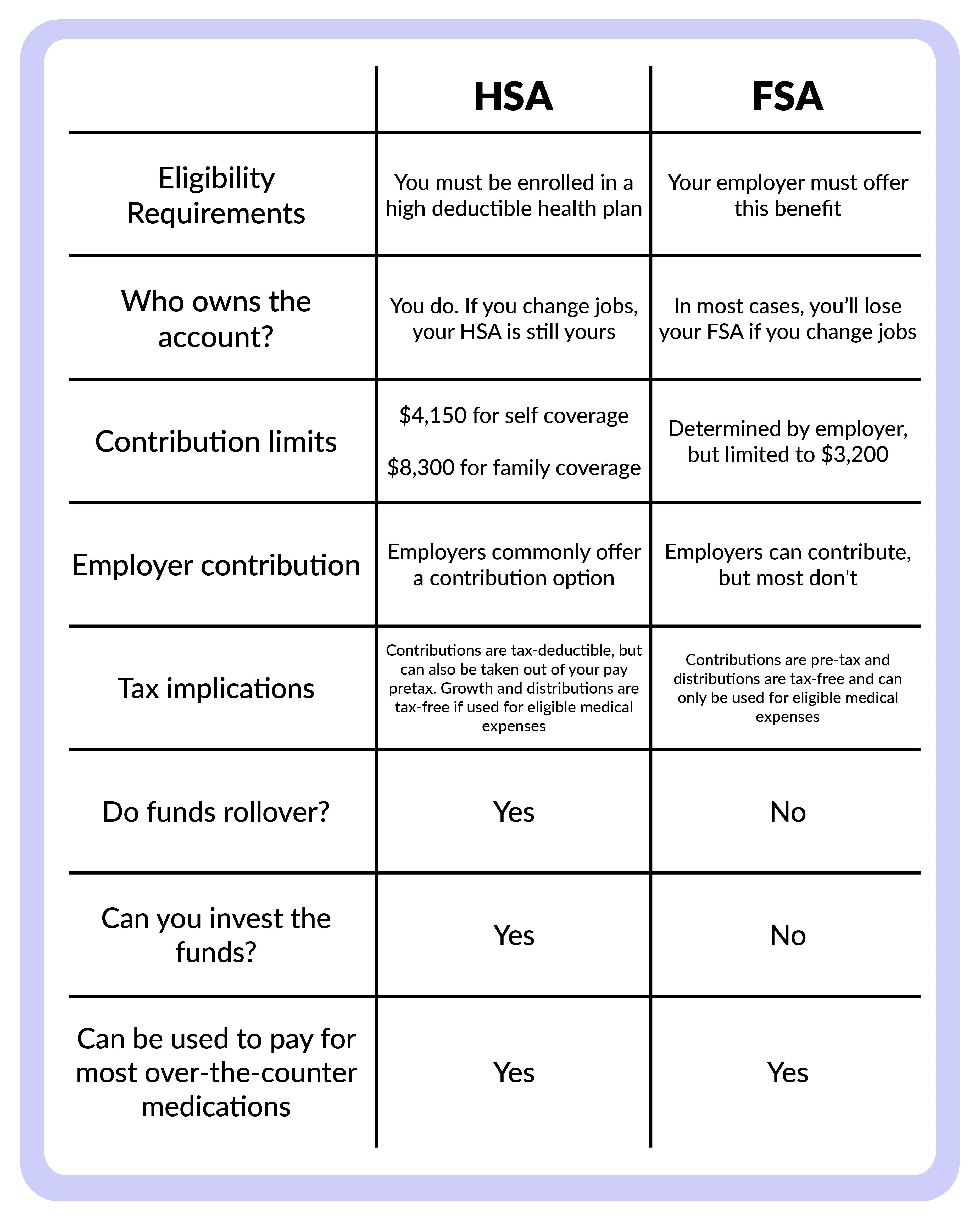

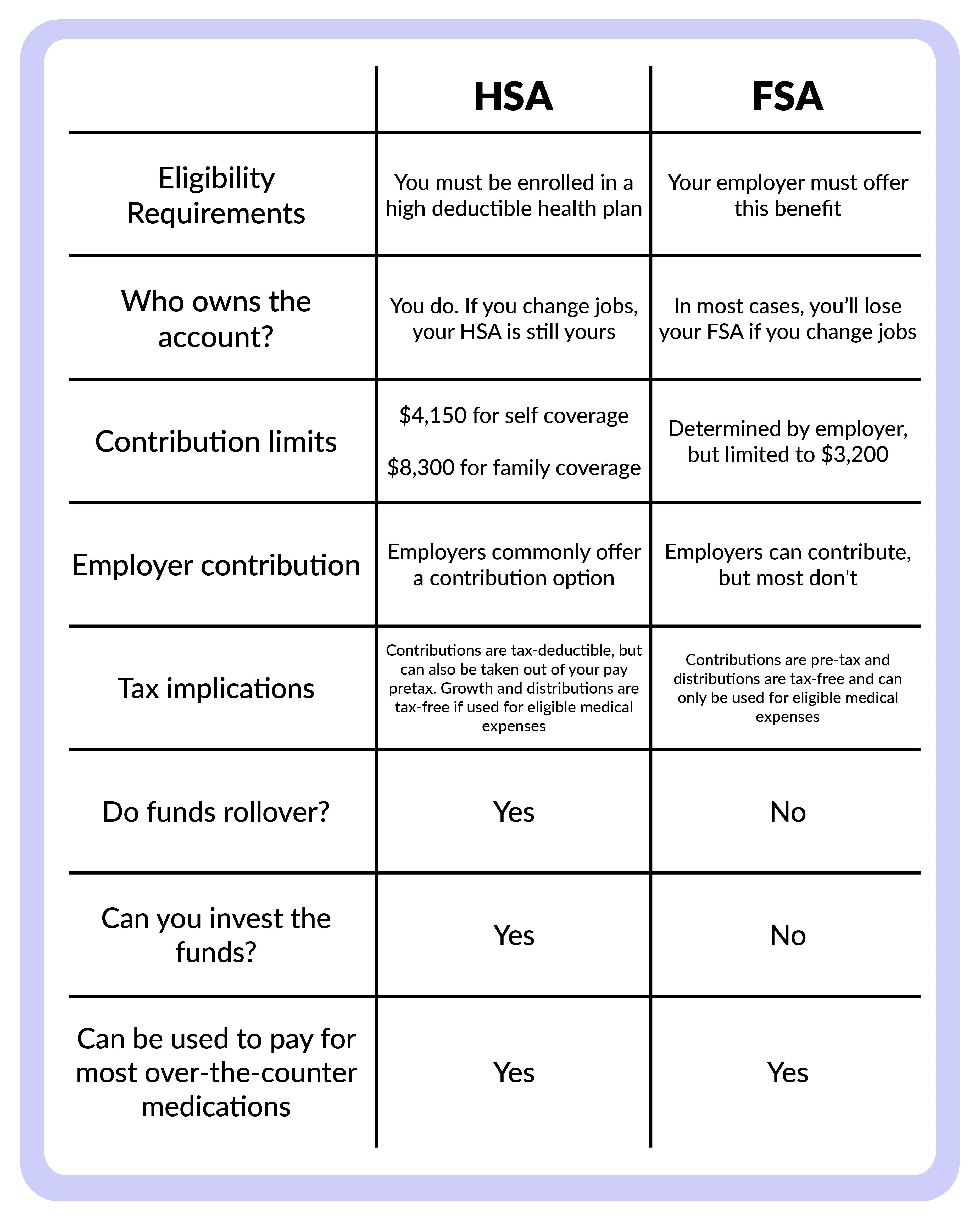

HSA vs FSA Comparison Chart:

For the visual learners out there, here are the differences between HSAs and FSAs presented as a handy little chat:

What Can You Use Your HSA and FSA For?

Both HSA and FSA funds cover a range of qualified medical expenses. Note that for some healthcare products and services that aren’t pre-qualified, you will need to present a Letter of Medical Necessity to demonstrate that the item addresses a specific health condition.

Here is a list of common HSA and FSA-eligible items:

Prescription medications

Doctor's visits

First aid supplies

Chiropractic services

And here is a list of common Items that require a Letter of Medical Necessity:

Certain over-the-counter medications

Specialized medical equipment

Even gym memberships!

How Does HSA and FSA Reimbursement Work?

The typical reimbursement process is simple, but can be a bit slow and requires you to be diligent about documentation.

Cover your expenses out-of-pocket or use your HSA/FSA debit card. Make sure the item or service is a qualified medical expense, otherwise you’ll need to get a LOMN from your healthcare provider that explains why the item is medically necessary.

Keep all the receipts.

Submit a reimbursement request through your HSA/FSA provider’s portal with the corresponding documentation.

Wait for the review and approval process by your HSA/FSA administrator.

Receive the reimbursement via direct deposit, a check, or an FSA debit card reload.

Flex Is the Easier Option for Using Your HSA/FSA

Flex makes using HSAs/FSAs to cover your medical expenses so much better.

Here’s how it works when a company has partnered with Flex:

If the item falls outside of standard IRS guidelines: You'll see a "checkout with Flex" option on the payment page and be guided through a process to obtain a Letter of Medical Necessity:

Fill out a short eligibility form, sharing relevant information with Flex’s medical team.

If you qualify, Flex sends the LOMN to you via email.

Then, simply enter your HSA or FSA card details and complete the purchase.

For pre-approved medical expenses: Flex makes purchasing eligible items easier. On the payment page you’ll see a "checkout with Flex" option. Pay for the product or service with your HSA or FSA card and checkout as usual. Flex will substantiate the purchase automatically. This means you don't need to submit for reimbursement.

Looking for HSA/FSA-eligible products? Flex Market offers a wide range of items from our partner brands. Check out how to make the most of your HSA or FSA!

HSAs and FSAs Are Healthcare Your Way

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) offer a unique blend of tax benefits and savings options to give you more control of your healthcare spending.

HSAs are particularly tax-advantaged and useful for investment growth while Healthcare FSAs provide a structured approach to managing medical costs, especially for those with predictable medical needs.

So whether you're rocking the triple tax advantage or embracing the pre-tax perks, make sure to contribute wisely, spend judiciously, and let your healthcare journey be one of financial well-being.

Imagine you could reduce the cost of your out-of-pocket medical expenses and take advantage of tax benefits all at the same time? What if you could use funds designated for health on fitness, nutrition, or even sleep products or services that actually improve your health for the long term, instead of only treating the symptoms of illness?

Enter HSAs and FSAs. These are tax-advantaged savings accounts that help you to pay for common healthcare expenses or to be proactive about choosing products or services that address a specific medical condition which insurance might not cover.

If you're feeling confused or overwhelmed trying to understand HSA and FSAs, you’re not alone! Sixty-five percent of Americans struggle with the basic benefits and differences between these accounts. Flex is here to help you understand all the most important aspects of HSAs and FSAs so you can make the right decisions for your health and finances.

What Is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged financial account set up exclusively for health-related expenses. It is not health insurance, but rather a complementary savings account that lets you put money away for medical fees while also reducing your taxable income.

To qualify, you must be enrolled in a high-deductible health plan (HDHP). Because these types of health insurance plans have cheaper premiums but higher out-of-pocket expenses, HSAs can help reduce your costs and round out your coverage.

When used effectively, HSAs can serve as your golden ticket to pre-tax contributions, potential investment gains, and a treasure chest of tax-free withdrawals for qualified medical expenses!

What is the Difference Between an HSA/FSA and a Regular Insurance Plan:

HSAs and FSAs are not insurance policies. Instead, they serve as dedicated accounts for healthcare expenses not covered by your insurance.

The big idea is that they work together to give consumers more choice in their healthcare because you can be more selective about where and how to spend your money.

Why Should You Open an HSA or FSA?

So what’s the benefit of having an HSA or FSA? If you have health insurance, why would you need this?

The long and short of it is that HSAs and FSAs can help you save money. On average, consumers save 30 to 40% percent on purchases they make with their HSA/FSA. In real money terms, by using an HSA, the average person could save $955 on taxes in a single year and up to $1,909 for the whole family.

With an HDHP, consumers can pay more before they reach their deductible, so HSAs and FSAs can help cover out-of-pocket expenses until the maximum is reached.

Beyond this, your insurance may be limited in the scope of products or services it will cover so you will always have some amount of out-of-pocket expenses. Those could include common things like copays, prescriptions, or vision care to preventative medicine products or services like metabolic testing, fitness trackers, and nutrition counseling… as long as they meet the criteria of treatment, prevention, or mitigation of a specific medical condition.

Lastly, it is common for employers to have a contribution match for HSAs, which means free money in your account.

HSAs’ Triple Tax Advantage — What Are the Tax Benefits?

The beauty of HSAs lies in their triple tax advantage. In short:

Contributions are tax-deductible

Growth within the account is tax-free, and

Withdrawals for qualified medical expenses are tax-free

So, not only do you save on income tax, but you can invest your HSA money in a variety of investment tools (including mutual funds, stocks, bonds, ETFS, and CDs) for returns that are tax-free. This allows you to potentially grow your healthcare savings over the long term.

This triple tax benefit makes HSAs an awesome financial planning tool. Talk about a win-win-win.

How to open an HSA:

In order to open an HSA, you need to have a high deductible health plan, or HDHP. For a health plan to qualify as high deductible, it must have a deductible of at least $1,600 for an individual plan or $3,200 for a family plan in 2024.

Unfortunately, you cannot open an HSA while on Medicare or if you’re claimed as a dependent on someone else's tax return.

HSAs are most commonly offered along with your healthcare plan through your employer but they don’t have to be. If you purchased an HDHP on the open market, for example, you could go directly to an HSA provider and open an account directly. Several of the largest providers are Lively, HealthEquity, and Fidelity.

Opening an HSA is straightforward:

Check if you qualify for an HSA

Choose an HSA provider

Gather your personal info - social security number, contact details, and employment information

Choose between individual and family coverage

Open the account, put the funds in and… voila!

When you open an HSA or FSA, you’ll most likely receive a debit card which allows you to purchase eligible items directly. Alternatively, you can collect receipts from eligible purchases and submit them to your account provider for reimbursement.

Can anyone open an HSA?

Sadly, not everyone has access to an HSA. To qualify, you must be covered by a high-deductible health plan, not be enrolled in Medicare, and you cannot be claimed as a dependent on someone else's tax return.

How to set up an HSA if you are self-employed:

Self-employed folks can also sign up for an HSA. You just need to select an HSA-eligible HDHP and open an HSA through the financial institution of your choice. Contributions can be made on a pre-tax basis, lowering your taxable income, and can be used as a tax investment tool.

How do HSA Contributions and Withdrawals Work?

HSAs are an account that you own (unlike Flexible Spending Accounts, which we cover below), which means that if you change jobs or retire it’s still yours. When it comes to using it, though, here are the 5 main rules you need to know:

Review what qualifies as a qualified medical expense: HSAs are designed for qualified medical expenses which the IRS says “must be primarily to alleviate or prevent a physical or mental disability or illness.” The link has a comprehensive list of approved items. However, you can also pay for items that aren’t pre-approved if you receive a Letter of Medical Necessity from a healthcare professional (more on this below). Either way, keep receipts handy for documentation.

You can withdraw at any time: The flexibility of HSAs shines as you can withdraw funds at any time. There's no rush; your HSA is a long-term companion for healthcare needs.

Post-65 flexibility: Once you hit 65, the game changes. While you can still use HSA funds for medical expenses tax-free, non-medical expenses become fair game without the usual 20% penalty.

Non-qualified expenses before 65: Withdrawals for non-qualified expenses before the age of 65 incur income tax plus a 20% penalty.

Reimbursement timing: HSAs don't mandate immediate reimbursement. You can pay out of pocket, let your HSA funds grow through investments, and reimburse yourself later for qualified expenses.

What are the HSA contribution limits for 2024:

As of 2024, the annual HSA contribution limit for individuals is $4,150, and $8,300 for families. These change on a yearly basis, though, so stay informed about any potential updates.

Can employers contribute to my HSA?

Yes, employers can contribute to your HSA, which could enhance your savings even further. Just remember that the rules still apply: Your combined contributions can't exceed the annual contribution limit.

How much should I contribute to my HSA?

As much as you can without breaking the bank, or exceeding the IRS limits. Your HSA sweet spot depends on various factors, including your health expenses, financial situation, and future healthcare needs, which are always a guess. Nailing the balance is crucial to maximize the benefits of your HSA.

HSA Withdrawal Rules and Guidelines:

HSA withdrawals are not that complex, but there is still some finessing to be done. Read on for more details.

Can I withdraw the funds from my HSA at any time?

Yes, you can withdraw funds from your HSA at any time. However, if the withdrawals are not for qualified medical expenses, they will be subject to income tax and a 20% penalty for individuals under 65.

What Is the penalty if you use funds for non-qualified expenses?

Using HSA funds for non-qualified expenses before the age of 65 will net you a 20% withdrawal penalty on top of regular income tax.

The withdrawn amount for non-qualified expenses will generally be included in your taxable income for the year in which the withdrawal occurred. This means you'll need to report the distribution on your income tax return, and it will be subject to your regular income tax rate.

Once you hit 65, you can make withdrawals from your HSA for any reason without incurring the 20% penalty. However, if the withdrawals are not used for qualified medical expenses, they’ll still be subject to regular income tax.

Do HSA Funds Expire?

No, HSA funds do not expire. Unlike some FSAs, your HSA balance carries over from year to year, allowing you to accumulate savings for future healthcare needs.

Some Common Questions About HSAs:

Can I Have an HSA and Medicare?

If you were enrolled in an HSA before going on Medicare, you can keep your account. However, you can't contribute to the HSA after going on Medicare. You can still use existing HSA funds for qualified medical expenses, though.

Can my spouse use my HSA?

Yes, your spouse can use the HSA funds for their qualified medical expenses, even if they are not covered by the same HDHP.

HSA vs HRA: What's the difference?

Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs) are both tools to help you with healthcare expenses, but they differ in structure and how contributions and withdrawals are managed. The disparity is that HRAs are employer-funded accounts, while HSAs can be funded by both employers and individuals.

Is an HSA worth it?

Absolutely! The triple tax advantage, flexible contributions, and tax-free withdrawals for medical expenses make it a star player in your financial lineup. It's not just about saving on taxes; it's about taking control of your healthcare dollars.

If you're a savvy spender, enjoy tax breaks, and want a savings account that grows with you, the HSA can be your financial MVP. It's worth it for the peace of mind, the potential for growth, and the freedom to shape your financial future.

Now onto another popular savings account, the FSA.

What is an FSA?

Flexible Spending Accounts (FSAs) are employer-sponsored benefit plans that let you set aside pre-tax money from your paycheck to cover healthcare and dependent care expenses.

In this article, will be focusing on the healthcare kind.

How Does FSA Work?

Your Healthcare FSA is a budgeting wizard. You decide how much money to contribute pre-tax annually, and it's deducted from your paycheck. By doing this, you are creating a stash that can be tapped for various qualified medical expenses, providing you with tax savings.

What are the benefits of an FSA?

FSA benefits include tax savings, flexibility in healthcare spending, and a lower taxable income. Plus, unlike HSAs, there is no requirement for a high deductible health plan (HDHP).

How to open an FSA

Opening an FSA is typically a breeze through your employer during open enrollment:

Confirm if FSA is in your employer’s benefits package.

Determine the contribution amount and contribute as much as you want during the open enrollment period.

Read through your FSA plan rules and complete the enrollment forms.

It’s as easy as that!

How do FSA contributions and withdrawals work?

You determine your contributions before the plan year begins. For 2024, the FSA contribution limit is up to $3,200. Then, if you need to finance a medical procedure, examination, or any other qualified expense, just dip into the fund!

While FSAs offer significant advantages, they typically come with a "use it or lose it" rule. Most FSA funds not used by the end of the plan year are forfeited, although your boss may offer a grace period or a limited rollover option.

Is an FSA Worth It?

If you have predictable medical expenses, the tax savings alone make an FSA a worthwhile financial ally. Just be mindful of the use-it-or-lose-it aspect when planning how much money to invest in it.

HSA vs FSA Comparison Chart:

For the visual learners out there, here are the differences between HSAs and FSAs presented as a handy little chat:

What Can You Use Your HSA and FSA For?

Both HSA and FSA funds cover a range of qualified medical expenses. Note that for some healthcare products and services that aren’t pre-qualified, you will need to present a Letter of Medical Necessity to demonstrate that the item addresses a specific health condition.

Here is a list of common HSA and FSA-eligible items:

Prescription medications

Doctor's visits

First aid supplies

Chiropractic services

And here is a list of common Items that require a Letter of Medical Necessity:

Certain over-the-counter medications

Specialized medical equipment

Even gym memberships!

How Does HSA and FSA Reimbursement Work?

The typical reimbursement process is simple, but can be a bit slow and requires you to be diligent about documentation.

Cover your expenses out-of-pocket or use your HSA/FSA debit card. Make sure the item or service is a qualified medical expense, otherwise you’ll need to get a LOMN from your healthcare provider that explains why the item is medically necessary.

Keep all the receipts.

Submit a reimbursement request through your HSA/FSA provider’s portal with the corresponding documentation.

Wait for the review and approval process by your HSA/FSA administrator.

Receive the reimbursement via direct deposit, a check, or an FSA debit card reload.

Flex Is the Easier Option for Using Your HSA/FSA

Flex makes using HSAs/FSAs to cover your medical expenses so much better.

Here’s how it works when a company has partnered with Flex:

If the item falls outside of standard IRS guidelines: You'll see a "checkout with Flex" option on the payment page and be guided through a process to obtain a Letter of Medical Necessity:

Fill out a short eligibility form, sharing relevant information with Flex’s medical team.

If you qualify, Flex sends the LOMN to you via email.

Then, simply enter your HSA or FSA card details and complete the purchase.

For pre-approved medical expenses: Flex makes purchasing eligible items easier. On the payment page you’ll see a "checkout with Flex" option. Pay for the product or service with your HSA or FSA card and checkout as usual. Flex will substantiate the purchase automatically. This means you don't need to submit for reimbursement.

Looking for HSA/FSA-eligible products? Flex Market offers a wide range of items from our partner brands. Check out how to make the most of your HSA or FSA!

HSAs and FSAs Are Healthcare Your Way

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) offer a unique blend of tax benefits and savings options to give you more control of your healthcare spending.

HSAs are particularly tax-advantaged and useful for investment growth while Healthcare FSAs provide a structured approach to managing medical costs, especially for those with predictable medical needs.

So whether you're rocking the triple tax advantage or embracing the pre-tax perks, make sure to contribute wisely, spend judiciously, and let your healthcare journey be one of financial well-being.

Flex is the easiest way for direct to consumer brands and retailers to accept HSA/FSA for their products. From fitness and nutrition, to sleep and mental health, Flex takes a holistic view of healthcare and enables consumers to use their pre-tax money to do the same.